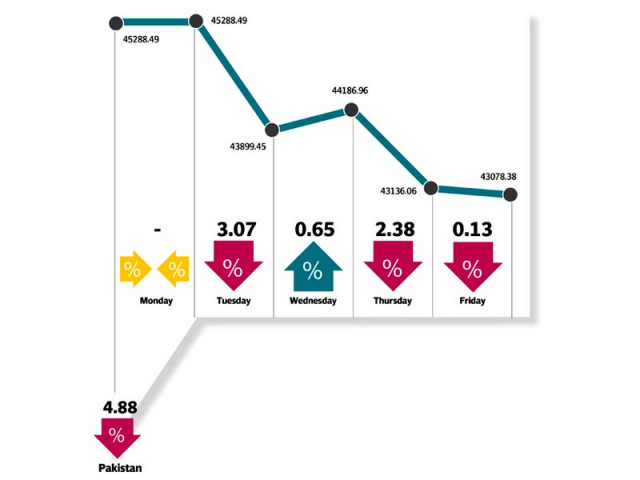

KSE-100 hits year’s lowest level as political uncertainty weighs

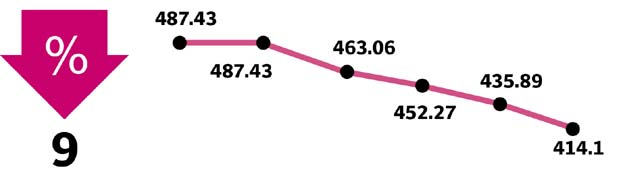

Benchmark index sheds 2,210 points in outgoing week

Political uncertainty due to Pakistan Awami Tehreek’s sit-in in Punjab that was called off at the last moment, NAB’s investigation into the conduct of former prime minister and his sons and redemption calls by mutual funds prompted selling and dragged the stock index into the red zone.

The Pakistan Stock Exchange opened Tuesday on a bearish note with the index plunging over 1,300 points. However, Wednesday saw a turn of events and the index made a reasonable recovery of 287 points.

Further political developments dampened investor sentiments, resulting in a massive dip in the following two sessions. The index closed at the lowest level for the current year and also tested a new intra-day low for the year, dipping to 42,347 points.

Market watch: With over 1,000-point plunge, KSE-100 hits lowest level in 8 months

From its peak of 52,876.46 on May 24, 2017, the index has plunged 19% as political and economic concerns weighed on investor sentiments.

In the backdrop of persistent uncertainty, investor participation in the market slowed down, pushing the average daily volumes down by 3.4% week-on week to 183 million shares, while average daily trading value rose 2.5% to $94 million.

Major trading was witnessed in small-cap stocks led by Azgard Nine (57.2 million shares), Aisha Steel Mills (41 million), TRG Pakistan (39.2 million) and The Bank of Punjab (38.8 million). Index-heavy sectors including commercial banks and exploration and production companies were down 4% and 3% respectively. Cement and fertiliser sectors fell 7% and 5% respectively.

A risk of demand slowdown and concerns over price war piled pressure on cement stocks while weak demand and excess inventory levels pushed the fertiliser companies down.

Stock-wise, the largest negative contribution came from Habib Bank (161 points) and Engro Corporation (96 points) following lower-than-expected results. DG Khan Cement, Searl and MCB Bank also contributed negatively, pulling the index down by 266 points.

In the week under review, mutual funds and foreign investors remained the largest net sellers of $24 million and $2 million, respectively. Mutual funds were keen to rebalance their portfolios to adjust for seemingly tumultuous political and economic climate.

Most of the selling by foreign investors was registered in exploration and production companies ($4.2 million) and commercial banks ($3 million) while buying interest was seen in food and personal care products at $10 million.

On the domestic front, banks and individuals looked to take advantage of the weak asset prices following relentless selling.

Market watch: KSE-100 snaps three-day losing streak, ends in the green

Among key highlights of the week were cut in rates for Sui Southern Gas Company by Rs10 per unit, plan announced by Maple Leaf to raise Rs4.3 billion through a right share issue, 162% surge in foreign direct investment to $222.6 million in July and continued decline in foreign currency reserves of the central bank.

Winners of the week

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts and a number of kinds of health foods.

Crescent Jute

Crescent Jute Products Ltd manufactures and markets jute and cotton textiles.

Soneri Bank

Soneri Bank Limited provides banking services.

Losers of the week

Pak Suzuki Motor

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

The Searle Company

The Searle Company Limited manufactures and sells pharmaceutical and healthcare products. The company also sells a range of food products and consumer items.

Ferozsons Laboratories

Ferozsons Laboratories Ltd manufactures and sells pharmaceutical products.

Published in The Express Tribune, August 20th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ