HUBCO profit dips 9% due to plant overhaul

Company earns Rs11.34b, declares Rs2.5 per share final dividend

PHOTO: HUBCO

The leading independent power producer had registered a profit of Rs12.50 billion in the preceding year.

Accordingly, earnings per share fell to Rs9.24 in FY17 compared to Rs10.29 last year.

Hubco offers shareholding to Chinese company, Fauji Fertilizer

Hubco’s board of directors recommended a final cash dividend of Rs2.50 per share, which was in addition to the Rs5 per share already paid earlier this year.

Its stock price fell 2.19%, or Rs2.54, at Rs113.33 with a volume of 873,500 shares at the Pakistan Stock Exchange (PSX).

JS Research analyst Mehwish Zafar said in post-result comments “we believe higher O&M (operating and maintenance) expenditures (explained by the ongoing overhauling at the Narowal plant) led to the lower profitability.”

Elixir Research analyst Syavash Pahore said in a note to clients that capacity utilisation in FY17 came in at 64.4%, 71.3% and 57.6% for Hub, Narowal and Laraib plants, respectively.

Work kicks off on $2b Hubco coal-power plant

Full-year dividends were down 32% year-on-year as the company sped up equity injections into associated ventures, namely, China Power Hub Power Company (CPHPGC) and Thar Energy Limited (TEL).

“Lower dividends could continue going forward as the company requires nearly $300 million for equity injection into CPHPGC and TEL,” he said. “In the absence of any major overhaul, earnings should rise in FY18.”

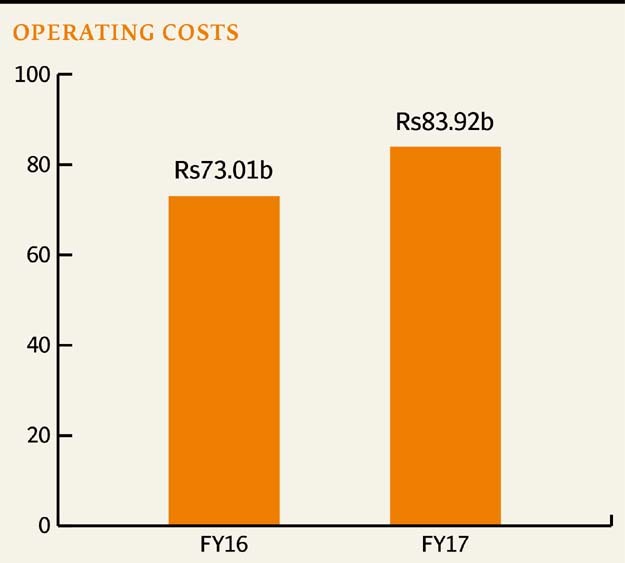

According to the company’s profit and loss account, its operating costs increased 15% to Rs83.92 billion from Rs73.01 billion.

The cost surge ate up a 10% gain in turnover (sales) to Rs101.18 billion from Rs91.59 billion last year. Finance costs remained stable at Rs4.08 billion.

Published in The Express Tribune, August 18th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ