China’s Belt and Road acquisitions surge to $33b

Amount surpasses the $31 billion tally for the whole of 2016

Chinese President. PHOTO: REUTERS

Chinese acquisitions in the 68 countries officially linked to President Xi Jinping’s signature foreign policy totalled $33 billion as of Monday, surpassing the $31 billion tally for all of 2016, according to Thomson Reuters data.

Unveiled in 2013, the Belt and Road project is aimed at building a modern-day Silk Road, connecting China by land and sea to Southeast Asia, Pakistan and Central Asia, and beyond to the Middle East, Europe and Africa.

China leads as Pakistan sees FDI of $2.41b in 2016-17, up 5%

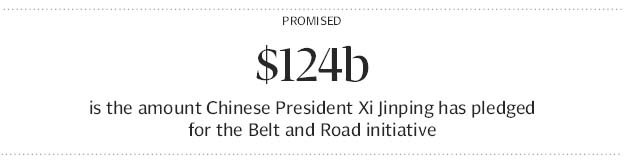

At a summit in May, Xi pledged $124 billion for the plan, but it has faced suspicion in western capitals that it is intended more to assert Chinese influence than Beijing’s professed desire to spread prosperity.

The surge in Chinese companies’ acquisition-linked investments in the Belt and Road corridor comes as the volume of all outbound mergers and acquisitions from China has dropped 42% year-on-year as of Monday, data showed.

Beijing’s move to prop up the yuan by restricting the flow of capital outside the country and clamp down on debt-fuelled acquisitions to ensure financial stability has made it tougher for buyers to win approvals for deals abroad.

Regulators have tightened the screws further since June, reviewing deal agreements in minute detail and ordering a group of lenders to assess their exposure to offshore acquisitions by several big companies that have been on overseas buying sprees, including HNA Group, Dalian Wanda Group and Fosun Group. The heightened regulatory scrutiny of overseas acquisitions comes after companies spent a record $220 billion in 2016 on assets overseas, buying up everything from movie studios to European football clubs.

The scrutiny, however, has not impacted Chinese companies’ pursuit of targets along the Belt and Road corridor as those investments are considered strategic for the companies as well as the Chinese economy.

“People are thinking in a long-term approach when making investments along Belt and Road countries,” said Hilary Lau, a corporate and commercial lawyer and partner at law firm Herbert Smith Freehills.

“The acquisitions are also policy-driven. There are funds allocated by Chinese banks and state funds for Belt and Road deals,” he said.

The number of Chinese deals targeting Belt and Road countries totalled 109 this year compared to 175 in the whole of last year and 134 in 2015, the Thomson Reuters data showed. The largest deal in a Belt and Road country so far this year was a Chinese consortium’s $11.6 billion buyout of the Singapore-based Global Logistics Properties.

CPEC praised for enhancing regional connectivity

Other top deals include the $1.8 billion purchase of an 8% ownership interest in an Abu Dhabi oil company by the state-owned oil giant China National Petroleum Corp and HNA Group’s $1 billion acquisition of a logistics company, CWT Ltd, which has not yet closed. China’s State Administration of Foreign Exchange, said this month that domestic companies would still be encouraged to participate in Belt and Road activities.

Published in The Express Tribune, August 17th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ