Only 29% of NTN holders file income tax returns

30% of the filers do not pay tax as their income is below annual threshold of Rs400,000

PHOTO COURTESY: NEW PAKISTAN

The Tax Directory for fiscal year 2015-16 that ended in June last year carried names and the amount of tax paid by the income tax return filers. It was the fourth consecutive year for which the PML-N government released the tax directory.

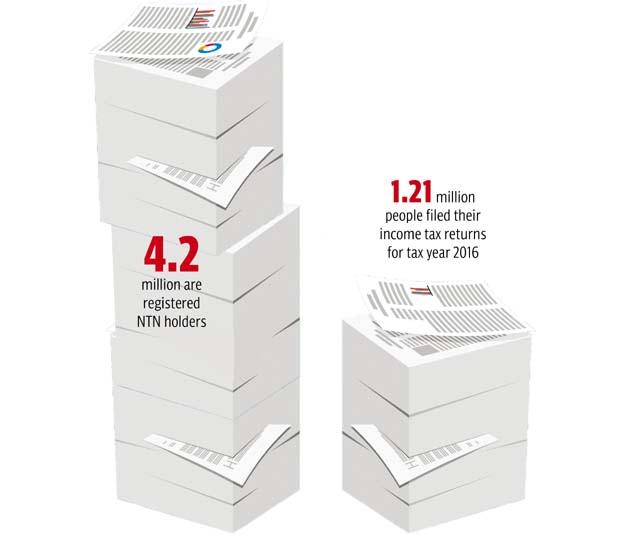

The initiatives taken by the government to broaden the tax base were yielding desired results due to which the number of taxpayers, who filed their returns, increased to 1.216 million compared with 1.074 million taxpayers in the directory for tax year 2015, said the finance minister at the launching ceremony. The number of return filers was higher by 13.2% or 142,196 people compared with the preceding year.

However, only 29% of the NTN holders filed income tax returns, highlighting weak enforcement by the Federal Board of Revenue (FBR). In Pakistan, 4.2 million people are registered NTN holders and the FBR could not do anything about the 2.98 million people who are not filing the returns.

The government has set different withholding and sales tax rates for filers and non-filers of income tax returns. There are 71 types of withholding taxes that cover almost every possible transaction and expenditure.

In order to avoid paying higher tax rates, people obtain NTN numbers, conduct transactions like car purchase and then forget about filing the returns.

Out of the 1.216 million who filed income tax returns, 366,000 or 30% of the filers did not pay any tax as their income was below the annual threshold of Rs400,000 in tax year 2016, said the finance minister. He said 850,614 people paid income tax in the tax year.

Under the law, all citizens of the country are bound to file income tax returns after the close of a fiscal year. Pakistan has one of the lowest tax-to-GDP ratios in the world as the country’s tax system is plagued with exemptions.

A recent report of the World Bank says Pakistan’s tax capacity is estimated at 22.3% of gross domestic product (GDP). At the current market price, this translates into Rs7.2 trillion.

However, the FBR collected Rs3.362 trillion in taxes during fiscal year 2016-17 that ended in June this year. The tax-to-GDP ratio remained stagnant at 10.57% in the year.

The size of tax gap - the difference between actual collection and the potential - is directly related to the extent of tax evasion in the country. The low tax-to-GDP ratio has trapped the country into a cycle of low investment and low economic growth.

The FBR had posted 8% growth in revenue collection in the last fiscal year, which was even lower than the nominal GDP growth, highlighting huge revenue slippages.

Dar did not respond to a question regarding the low growth in revenues in the previous fiscal year. The finance minister said when the PML-N government came to power, the number of income tax return filers was just 769,892. This included 40% or 307,000 people who had income below the threshold.

Dar said during the four-year period, the number of real taxpayers, who actually paid taxes along with returns, increased over 50%.

He, however, said there was still a huge potential and the FBR would have to redouble its efforts to raise revenues for meeting defence and development needs of the country.

Published in The Express Tribune, August 12th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ