Market watch: KSE-100 closes marginally negative

Benchmark index falls 9.51 points to end at 45,908.39

Stock exchange. PHOTO: AFP

The KSE-100 Index opened positive but quickly lost momentum to hit an intra-day low of 45,857.92 points. Later, it posted recovery but closed in the red zone.

At close, the benchmark KSE 100-share Index recorded a fall of 9.51 points or 0.02% to finish at 45,908.39.

According to Elixir Securities, Pakistan equities closed flat in a lacklustre trading session where benchmark KSE-100 Index traded in a narrow range of 250 points.

Market watch: Positive streak comes to an end at PSX

“Start to the day was on a positive note with oils leading gains, tracking higher global crude, and helping Index to retest important resistance level of 46,100,” stated the report.

However, it couldn’t sustain its morning run and erased all gains by day’s close as participants, likely wary of uncertain direction of market, chose to book profits.

Activity in the wider market dropped again on Wednesday as Index names saw very selective participation from institutional investors. One highlight was Fauji Fertilizer (FFBL PA 1.5%) as the company disclosed its intention of investing additional Rs2 billion in its subsidiary Fauji Foods (FFL PA +5%) via right shares subscription.

“[We] see listless trading in near-term with stocks trading range-bound and Index consolidating in a range of 500 points,” stated Elixir.

“Ongoing results season is not expected to create much excitement given uncertainty on domestic politics and most participants will likely continue to wait for SC decision in Panama probe against First family.”

Meanwhile, JS Global analyst Maaz Mulla said that the KSE-100 index remained dull during the day, owing to jitters from the political backdrop. “Despite dull activity, the market appeared to consolidate as prices have fallen down to extremely attractive levels,” said Mulla.

Market watch: KSE-100 bounces back before long holidays

Meezan Bank (MEBL -0.52%) from the commercial banks declared its 1H2017 result. In its result the bank posted EPS of Rs3/share.

“E&P sector gained to close (1%) higher than its previous day close as oil prices continued their upward trend. POL (+2.02%) and PPL (+1.46%) were the major gainers of the aforementioned sector.

“Moving forward, we expect market to remain volatile as investors await the final verdict of the Supreme Court on Panama case, and recommend investors to stay cautious and utilise opportunities to reduce short-term positions,” Mulla added.

Overall, trading volumes fell to 175 million shares compared with Tuesday’s tally of 223 million.

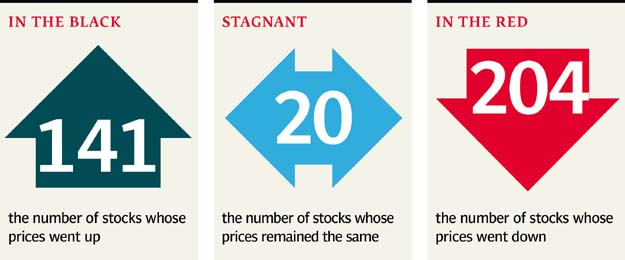

Shares of 365 companies were traded. At the end of the day, 141 stocks closed higher, 204 declined while 20 remained unchanged. The value of shares traded during the day was Rs8.3 billion.

Azgard Nine was the volume leader with 22.8 million shares, gaining Rs0.81 to close at Rs14.36. It was followed by Sui South Gas with 16.7 million shares, gaining Rs0.55 to close at Rs43.63 and Dewan Motors with 11.1 million shares, losing Rs1.38 to close at Rs42.81.

Foreign institutional investors were net sellers of Rs50.2 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ