KSE-100 index recovers, posts gain of 937 points

Uncertainty over Panama case verdict keeps market under pressure

Uncertainty over Panama case verdict keeps market under pressure. PHOTO:FILE

In the outgoing week, market players witnessed a slightly upward correction as value buyers jumped in to take positions ahead of the start of corporate results season, though most investors still remained on the side-lines in the face of political uncertainty.

As the Supreme Court resumed its proceedings in the Panama Papers case after a week’s adjournment, Monday recorded the lowest trading activity in three years as investors adopted a wait-and-see policy regarding the outcome of the case.

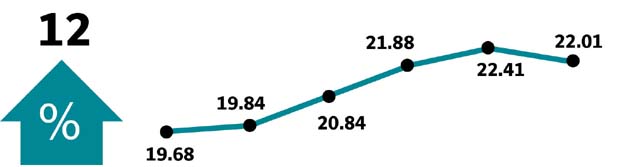

The market, however, remained positive at the end of the trading session. On Tuesday, the stocks bounced back with a bang, pushing the KSE-100 index over 1,100 points and it crossed the 45,000 barrier. The market remained under pressure and closed the next two sessions in the red, falling over 500 points.

As the court reserved its judgment in the case, domestic investors were relieved that no hasty action was being taken and took brave steps to accumulate stocks with attractive valuations. This led to an increase of 234 points in the KSE-100 index on Friday as it got vital support in second half of the trading session.

Volatility still prevailed in the market during the week over wild speculations about the outcome of the Panama case.

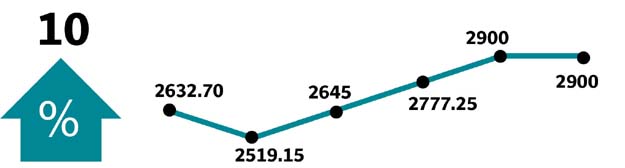

While the week was marked with choppy trading, investor participation slowed to a crawl as average volumes shrank 23% week-on-week to 134 million shares while average trading value fell 22% to Rs7.5 billion.

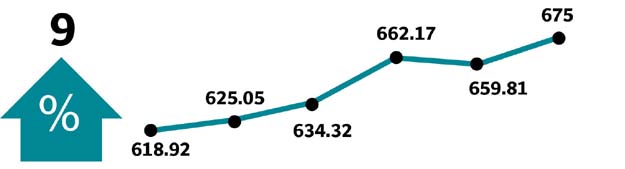

On the sector front, refineries (+6% week-on-week), exploration and production companies (+5.5%), auto assemblers (+4.6%), oil marketing companies (OMCs, +4.2%) and engineering firms (+3.7%) outperformed the broader market. They were followed by tobacco (+2.8%), pharma (+2.2%), cable and electric (+1.9%) and banks (+1.5%).

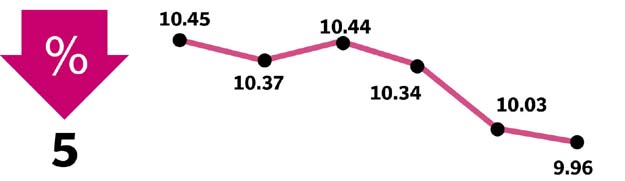

Foods (+1.2%), textile (+0.9%), cement (+0.7%), fertiliser (+0.5%), chemical (-0.5%) and power (-0.7%) underperformed.

Trading activity remained focused on sideboard stocks including TRG (51 million shares), Engro Polymer and Chemical (35 million) and K-Electric (32 million) that led the volume charts.

On an individual basis, participants were driven by value hunting with OGDC, United Bank Limited and Pakistan Petroleum adding the most to the index contributing 100 points, 69 points and 66 points respectively.

The biggest loser of the week was Engro (229 points) as the company fell short of market expectations with respect to its board meeting.

Foreign investors off-loaded $2.01 million during the week compared to net selling of $0.98 million in the previous week. Selling was concentrated in OMCs ($2.3 million) and power companies ($1.6 million) while buying was focused on cement stocks ($2.5 million).

On the domestic front, individuals resorted to selling of $5.66 million as political uncertainty lingered. Insurance companies and banks/DFIs were net buyers with an inflow of $9 million and $0.7 million, respectively.

Among major highlights of the week were current account deficit, up 148% in fiscal year 2017, SBP’s foreign exchange reserves, which plunged 4.44% at $15.48 billion, LSM sector, which posted 6.3% growth in May, PPL drilling 1.3km horizontal well for tight gas and ECC approving export of 0.3 million tons of sugar.

Winners of the week

Faysal Bank Limited

Faysal Bank Limited provides commercial, consumer and investment banking services.

Philip Morris (Pak) Limited

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Attock Petroleum

Attock Petroleum Ltd retails petroleum products. The company operates gasoline filling stations in Pakistan and Afghanistan.

Losers of the week

Feroze 1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Hum Network Limited

Hum Network Ltd operates satellite television channels. The company operates a channel targeted primarily at women, one about food and one that covers lifestyle and entertainment.

Bata Pakistan Limited

Bata Pakistan Limited manufactures and sells rubber, leather and microlon sandals and shoes.

Published in The Express Tribune, July 23rd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ