Weekly review: KSE-100 Index loses 885 points, down 1.96%

Political uncertainty continues to guide market in the red

Political uncertainty continues to guide market in the red

. PHOTO: INp

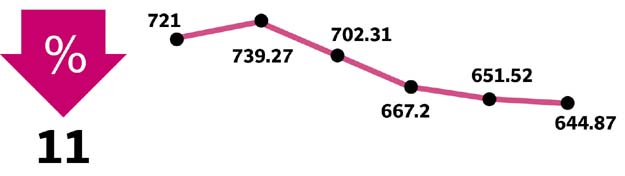

Recovering from the previous week’s massacre, where it was down 3%, the KSE-100 Index fared slightly better losing 885 points, down 1.96% week-on-week to close at 44,337.44 points.

Monday kicked-off with a massive rally of 1,051 points as the JIT submitted its final report and the Supreme Court adjourned hearing for a week.

However, positive sentiments were short-lived as Tuesday brought about an exact opposite of the events of the preceding day, and saw the index shed 2,153 points, down 4.65% - largest fall in terms of percentage since Feb 2009.

Driven by the political crisis that continued to unfold; the JIT report findings being made public, opposition parties’ calling for the prime minister’s resignation and Prime Minister Nawaz Sharif maintaining a tough stance, the index closed two more sessions in the red.

In light of the bearish trend that the market seemed to have adopted, SECP Chairman Zafar Hijazi - who is also facing charges of tampering with records of the Sharif family’s companies - visited the Pakistan Stock Exchange and encouraged brokers to give positive advice to investors.

Owing to this, Friday witnessed a slight recovery where the Index gained 554 points to close on a positive note.

The uncertainty has brought the index down to levels that were seen in December 2016.

With that said, downside to the index was led by cement (-176 points) due to unimpressive cement despatches during the month of Jun ‘17 amid Ramazan and monsoon rains, power generation & distribution (-89 points), fertilisers (-86 points), automobile assembler (-84 points) as car sales slowed down in Jun’17 amid shorter working days in Ramazan, and oil and gas marketing companies (-76 points).

On an individual basis, Pakistan Petroleum (PPL) contributed 47 points due to Sui’s wellhead gas price revision to PP2012, while UBL (-82 points), HUBC (-77 points), DGKC (-86 points), DAWH (-59 points), and ENGRO (-56 points) tanked the index.

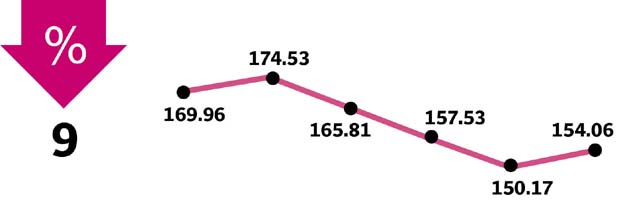

Overall activity witnessed improvement, with average trading volumes up 5% week-on-week from 166 million to 175 million, while value stood at $92 million. Activity was focused in retail favourite stocks, which included KEL (69 million), TRG (55 million), BOP (47 million), EPCL (35 million) and ASL (29 million).

Insurance companies were the largest domestic buyers with inflows of $15.7 million, while foreigners bought $1 million during the week against selling of $5.8 million last week. Buying was concentrated in banks ($4 million) and E&P’s ($1.4 million); while foreigners sold $3.4 million of cement, $1.9 million worth of oil marketing companies and $1.3 million of power generation. On the domestic front, individuals and mutual funds remained net sellers with $10 million and $8.3 million outflows, respectively.

Winners of the week

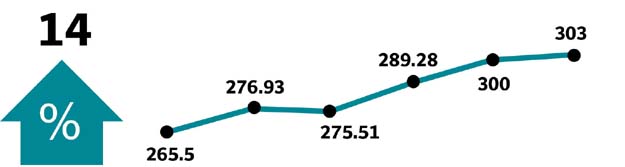

National Foods Limited

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts and a number of kinds of health foods.

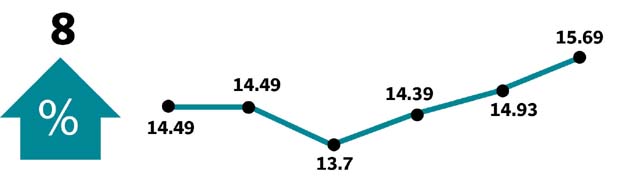

Soneri Bank

Soneri Bank Limited provides banking services.

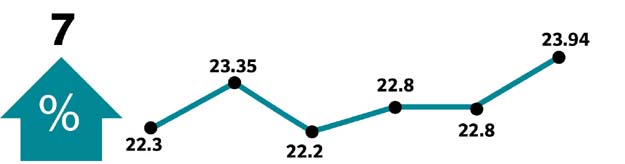

Standard Chartered Bank

Standard Chartered Bank Pakistan Limited is an international bank that provides consumer and wholesale banking.

Losers of the week

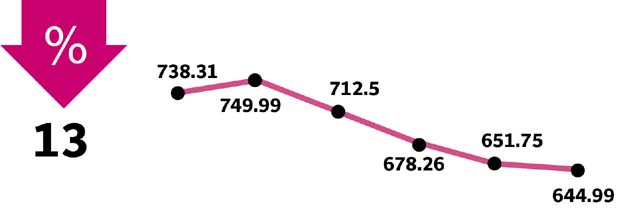

Honda Atlas Cars

Honda Atlas Cars Pakistan Limited manufactures, assembles and sells Honda vehicles through its many divisions within Pakistan.

Pak Suzuki Motor

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Published in The Express Tribune, July 16th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ