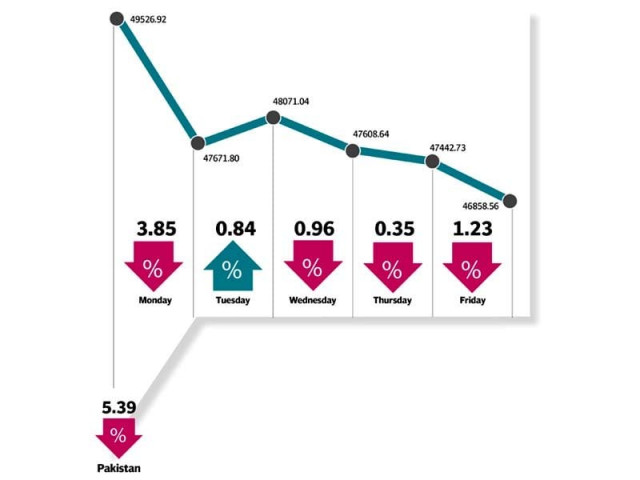

Weekly review: KSE-100 ends at its lowest level of 2017

Political uncertainty, international crude prices maintain pressure during outgoing week as index falls 5.4%

Weekly review: KSE-100 ends at its lowest level of 2017

The KSE-100, which last closed at 46,874.37 ahead of the Panama verdict, ended Friday at 46,859 points with political uncertainty and falling crude prices taking their toll even as the government clarified the new Capital Gains Tax regime due to take effect from next month.

The week opened on a negative note as stocks took a battering on account of panic over news that the prime minister is due to appear before the Joint Investigation Team, as part of the ongoing Panama case proceedings. This led to the index plunging over 1,950 points in intra-day trading on Monday. Although the market staged a slight recovery the next day, the remaining three days of the week saw the index closing in the red.

Clouds of political uncertainty deterred investors from taking fresh positions in equities.

That said, value traded declined 8.4% week-on-week to $103 million, while average trading volume inched up 7% week-on-week to 255 million shares as compared to 239 million in the previous week, while small cap stocks (KEL, EPCL, TRG, DSL and WTL) dominated the volume rankings, accounting for 32% of the overall volumes.

During the week, pressure was seen due to politics and oil, while foreign exchange reserves were reported at $20.15 billion, a 19-month low (Nov ‘15: $19.8billion).

On the sector front; oil took a major hit as E&Ps & OMCs shed 10.5% and 9.2%, respectively; sentiment towards 3% week-on-week decline in international crude prices was amplified by domestic politics and Gulf turbulence.

Fertiliser declined 6.3%, cement shed 5% while banking sector’s market capitalisation contracted by 3.2% during the week.

Among sectors that contributed to the 2,668-point decline were; oil and gas exploration companies (-546pts), fertiliser (-384pts), commercial banks (-304pts), oil and gas marketing companies (-282pts) and cement (-271pts).

Stock-wise, OGDC (-229pts) PPL (-159pts), ENGRO (-153pts) and HUBC (-129pts) remained the leading losers, whereas HBL (+30pts), and PAKT (+12pts) were the only two meaningful positive contributors for the week.

Among major highlights of the week; Shanghai Electric committed to K-Electric deal, National Assembly approved the budget denoting increase in minimum wages and changes in taxes, the government released Rs681 billion for uplift projects, trade deficit widened to a record $30 billion, oversubscription of PSX shares in book building and shelving of $2 billion Gwadar-Nawabshah gas pipeline project.

After a week of strong foreign portfolio inflows of $14.04 million, foreign investors chose to stay on the sidelines in the outgoing week with net selling of $9.49. E&Ps witnessed the largest sale of $6.59 million, followed by power with $2.9 million and fertilisers $2.2 million. Foreigners bought $1.8 million of cements.

On the local front, insurance companies were the largest accumulators at $18.78 million, supported by banks and individuals by $5.98 million and $4.84 million, respectively, whereas mutual funds and companies remained largest (net) sellers at $9.98 million and $6.45 million, respectively.

Winners of the week

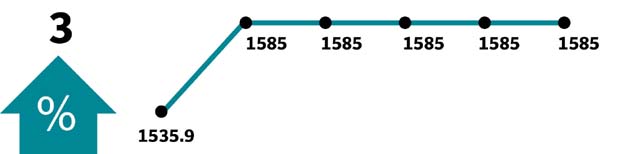

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

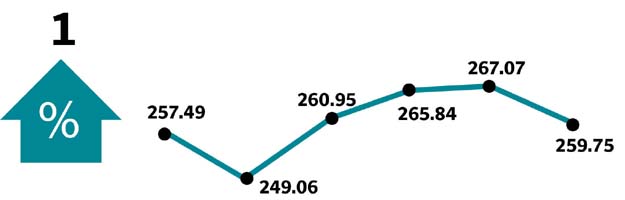

Habib Bank Limited

Habib Bank Limited operates a commercial bank in Pakistan. The bank offers commercial, corporate, investment, retail and international group banking.

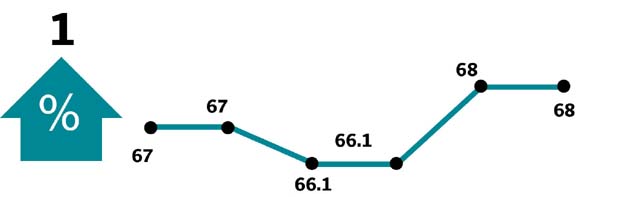

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Limited also owns an in-house power generation plant.

Losers of the week

Oil and Gas Development

Oil and Gas Development Company Ltd explores and develops oil and natural gas properties in Pakistan.

Pakistan Petroleum

Pakistan Petroleum Ltd specialises in the exploration and production of crude oil and natural gas. The company also sells liquefied petroleum gas and condensates.

Engro Corporation

Engro Corporation Ltd manufactures and markets fertilisers and plastics, generates electricity and processes food. The company produces nitrogenous, phosphatic and blended fertilisers, polyvinyl chloride resin and industrial automation products, develops electricity generating plants, produces dairy foods and operates a liquefied petroleum gas and liquid chemical terminal.

Published in The Express Tribune, June 18th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ