Market watch: Stocks succumb to profit-taking, index falls below 48,000

Benchmark index dips 462.40 points to close at 47,608.64

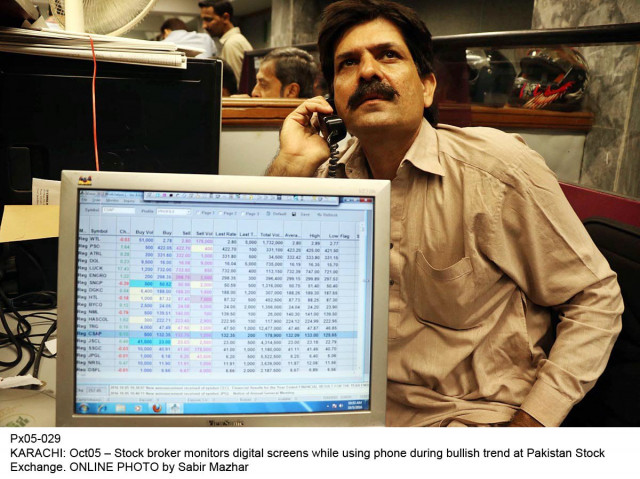

PHOTO: EXPRESS

The KSE 100-share Index jumped over 500 points as the trading began, but it could not sustain the momentum and embarked on a downward journey later. At the end of trading, the benchmark KSE-100 index recorded a fall of 462.40 points or 0.96% to close at 47,608.64.

According to Elixir Securities, Pakistan equities failed to build on Tuesday's gains and closed lower on reported profit-taking, primarily by institutions and prop books.

The market opened gap up in the morning and revisited highs above 48,600 as stocks carried the momentum while investors also cheered positive amendments in the Finance Bill that included clarification on the capital gains tax (CGT) as it would be applicable only to holdings bought post-July 2017 instead of being applicable to all holdings regardless of their date of purchase as was earlier feared.

KSE-100 ends positive, but after a rollercoaster ride

"Index, however, couldn't sustain gains for long as investors took advantage of the morning surge and resorted to booking profits amid prevailing political noise as PM Nawaz is expected to appear before the Panama case JIT (joint investigation team) on Thursday," stated the report.

Major dent came from Engro Corp (-2.5%), Oil and Gas Development Company (-1.4%), Hub Power (-1.8%) and Pakistan Oilfields (-3%) while small and mid-caps also gave way and closed in the red on retail selling.

"[We] see a volatile day on Thursday with anxiety persisting over the political noise while institutional flows in index names are expected to guide the broader market direction in the days ahead," the report added.

JS Global analyst Arhum Ghous said the market continued to remain volatile throughout the trading session, making an intra-day high of 531 points and a low of -586 points. It finally closed at 47,609, 462 points below the last trading day.

Govt looks to appease investors amid bloodbath at stock market

"Positivity in initial hours of the trading session came from the news that the government brought favourable changes in the new CGT structure for equity investors. However, oil stocks shed points as oil fell in the international commodity market," said Ghous.

OGDC (-1.38%), Pakistan Oilfields (-3.04%) and Pakistan Petroleum (-0.30%) from the oil sector closed in the red while commercial bank heavyweights including MCB Bank (-1.35%) and UBL (-0.06%) lost value in a declining market.

However, Habib Bank (+1.87%) closed in the green zone due to attractive valuations and investor optimism.

Engro Polymer and Chemicals opened at its upper circuit on the back of previous day's news regarding imposition of anti-dumping duty on PVC resin imports.

After three extensions, PSX shares slightly oversubscribed

"We recommend investors to stay cautious amid political unrest and avoid taking short-term positions," the analyst added.

Overall, trading volumes fell to 255 million shares compared with Tuesday's tally of 317 million.

Shares of 361 companies were traded. At the end of the day, 76 stocks closed higher and 267 declined while 18 remained unchanged. The value of shares traded during the day was Rs10.4 billion.

Power Cement (right shares) was the volume leader with 59.5 million shares, losing Rs0.32 to close at Rs0.21. It was followed by The Bank of Punjab (R) with 19.6 million shares, losing Rs0.20 to close at Rs0.37 and Dost Steels with 17.6 million shares, losing Rs1.00 to close at Rs13.01.

Foreign institutional investors were net buyers of Rs360 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ