Wealth management data startup Addepar raises $140 million

The start-up seeks to help established financial institutions improve their technology across wide range of functions

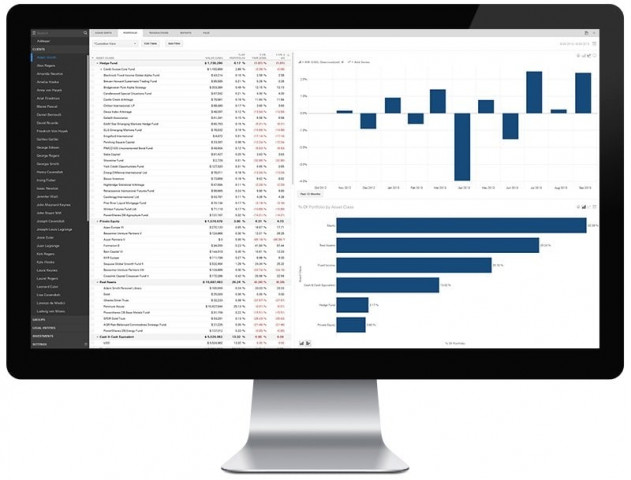

The start-up seeks to help established financial institutions improve their technology across wide range of functions. PHOTO: ADDEPAR

The company said on Thursday that it will use the funding on research and development initiatives aimed at enhancing its technology.

Addepar has developed software that helps wealth managers view information on their clients' assets that might be spread out across various accounts.

Ultra-wealthy clients typically hold their assets in family trusts, limited partnerships or in alternative and illiquid investments spread across several banks and accounts. This means financial advisors will often gather and compile information into one spreadsheet through a protracted process rather than meeting with clients.

HSBC partners with AI startup to combat money laundering

"Wealth managers, especially the ones serving larger and more complex clients, often times have challenges in giving each client an accurate view of everything they own," said Eric Poirier, chief executive of Addepar, in an interview. The company's platform allows wealth management firms, with client's permission, to gather information from various accounts in one place, Poirer said.

Addepar is among the growing group of young technology companies that are seeking to help established financial institutions improve their technology across a wide range of functions, including anti-money laundering checks to client-interface software.

FinTech, banks get Rs148m to innovate tech ideas for remittances

While the firm has so far focused on wealth management firms, Poirier said it had received inquiries from other buy-side companies such as pension funds.

Poirier said the firm has been growing rapidly, with its clients managing more than $650 billion through its platform, up from $300 billion 18 months ago. In January Morgan Stanley said it was rolling out Addepar's platform to 20 of its top financial advisory teams.

Valor Equity Partners founder and managing partner Antonio Gracias, who sits on the Addepar's board of directors, is well known for being an investor and board member in several companies of Tesla Inc founder Elon Musk.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ