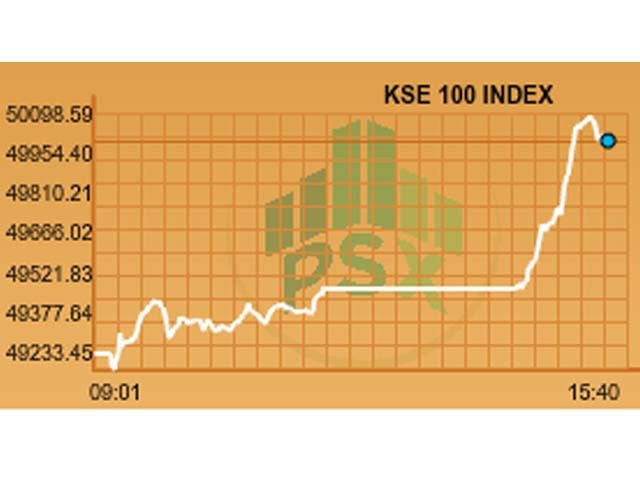

Market watch: MSCI excitement sees KSE-100 gain aggressively

KSE 100-share Index rises 567.48 points to end at 49,851.13

PHOTO:PSX

However, profit-taking at high levels meant the index settled 567.48 points up after momentum slowed down a bit.

Market watch: Stocks bounce back, snap four-day losing streak

The market’s excitement can mainly be attributed to the upcoming MSCI’s transition, which will change Pakistan’s status from frontier to emerging. This is expected to stimulate fresh foreign investment from around the globe.

At close, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index recorded a rise of 567.48 points, or 1.15%, to end at 49,851.13.

Elixir Securities analyst Ali Raza said Pakistan equities closed Friday with handsome gains as aggressive institutional buying over MSCI euphoria propelled benchmark the KSE-100 index to retest the coveted 50K level.

“Despite a weak start in the morning due to index heavy oils opening gap down and briefly stalling the momentum after losses in global crude, wider market got back on positive track helped by heavy Institutional buying primarily in MSCI names.”

Market watch: KSE-100 increases another 965 points

JS Global analyst Arhum Ghous said the local bourse remained largely in the 'green zone' during the last trading day of the week as KSE-100 index gained to make an intraday high of +815 points, closing up 567 points at 49,851 levels.

“Major index movers were UBL (+4.61%), Lucky Cement (+3.87%), HBL (+2.18%), MCB (+4.05%) and Engro (+2.57%) as they cumulatively contributed +408 points to the index.”

Exploration and production sector showed downward trajectory as the sector lost value to close 0.6% lower than its previous day close, said Ghous.

“Decline in E&P sector can be attributed to crude oil prices as they declined to trade at its six months low (WTI $45.39/bbl level).”

Pakistan Oilfields Limited (-1.22%) and Pakistan Petroleum Limited (-1.99%) were the major laggards of the aforementioned sector.

Market watch: Profit-taking continues as index takes a slight dip

Overall, trading volumes rose to 308 million shares compared with Thursday’s tally of 287 million.

Shares of 390 companies were traded. At the end of the day, 217 stocks closed higher and 152 declined while 21 remained unchanged. The value of shares traded during the day was Rs17.7 billion.

Engro Polymer was the volume leader with 37.5 million shares, gaining Rs0.57 to close at Rs30.93. It was followed by TRG Pakistan with 17.2 million shares, gaining Rs0.51 to close at Rs55.91 and K-Electric Limited with 14.6 million shares, losing Rs0.02 to close at Rs8.01.

Foreign institutional investors were net sellers of Rs502 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ