Index fails to keep momentum, tumbles after crossing 50k

KSE-100 falls 0.8% week-on-week to close at 49,301

KSE-100 falls 0.8% week-on-week to close at 49,301. PHOTO: AFP

The index edged down 0.8% week-on-week (408 points), closing at 49,301, and failing to sustain the 50k mark in the face of incessant foreign selling ($10.7 million during the week).

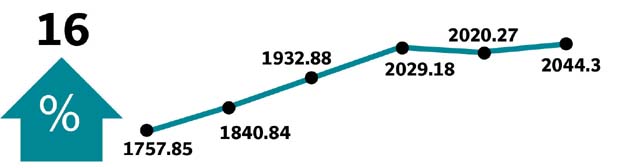

Investors looked to close-up shop and book gains ahead of the long weekend as excitement faded and triggers dried up amid the dull earnings results (barring autos). Autos along with tractors were the saving grace with auto assemblers up 12.3% week-on-week, while auto part manufacturers too garnered traction. Autos fetched lime light on account of announcement of Orange Cab scheme by the Punjab Government that would entail provision of 100,000 units, and strong quarterly readings for Millat Tracker Limited, Al-Ghazi Tractors, Agriauto Industries Ltd, Indus Motor and Pak Suzuki.

Market watch: Stocks bleed as KSE-100 endures another fall

Major contribution to the upside came from autos along with Pak Elektron & Pakistan Tobacco cumulatively contributing 291 points to the index. On the flip side, however, Pakistan Petroleum Limited, Hubco, Engro Corp, Fauji Fertilizer & Searle cumulatively contributed 478 points to the downside.

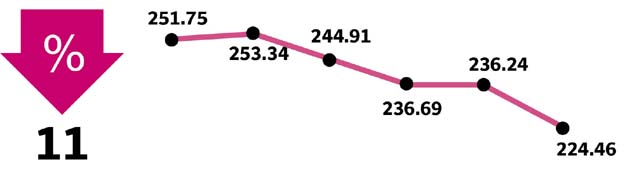

Funds (+$19.2 million) were the biggest buyers while foreigners were sellers of $10.7 million during the week as against selling of $32 million last week; with most of the selling concentrated in Cement ($5 million), Oil and Marketing Companies ($4.8 million) and exploration and production ($2.6 million), while foreigners bought $9.5 million worth of banks.

Weekly review: Volatile trading results in KSE-100 losing 0.7%

Foreigners remained net sellers offloading shares worth $10.7 million. Foreign selling was primarily mopped up by mutual funds (+$19.2 million) and individuals (+$10.8 million).

Average traded volume picked up 29% week-on-week averaging at 359 million shares, while value traded was up 7% week-on-week.

In the coming week investors’ interest is expected to pick-up ahead of the MSCI review on May 15, however, progress on JIT formed by the Supreme Court will also remain a key driver of market performance going forward.

Winners of the week

Pak Suzuki Motors

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Indus Motors

Indus Motor Company Limited was created through a joint venture agreement between the House of Habib, the Toyota Motor Corporation and the Toyota Tsusho Corporation, in order to assemble, manufacture and market Toyota vehicles. The company is also the sole distributor of Toyota vehicles in Pakistan.

Losers of the week

Ferozsons Laboratories

Ferozesons Laboratories Ltd manufactures and sells pharmaceuticals products.

Crescent Steel

Crescent Steel & Allied Products Limited manufactures steel lined pipes and multi-layer pipe coatings, which are used for water, oil and gas transmission. The company also has a cotton division that manufactures cotton yarn.

Cherat Packaging Limited

Cherat Packaging Limited manufactures and markets paper bags for the construction industry. The company manufactures various types of paper bags using clupak sack kraft paper imported from Austria, Sweden, and Czech Republic.

Published in The Express Tribune, April 30th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ