Pakistan adds another $115m loan to its growing debt

Borrowing continues after country fails to generate non-debt creating inflows

PHOTO: REUTERS

The fresh loan amount may not appear large, but indicates towards serious problems in attracting non-debt creating inflows and arranging funds from traditional and relatively cheap source of foreign financing. The $115 million lending was 60% of the total new loans that the government obtained in March.

How the debt issue remains circular in Pakistan

The PML-N government has so far obtained $655 million from Noor Bank of the UAE at an annual interest rate ranging from 4.1% to 4.71% after it came into power four years ago.

The government took these loans after it failed to attract sufficient non-debt creating inflows, like enhancing exports and foreign direct investment to meet its external financing requirements. In September last year, the Ministry of Finance admitted in a summary moved to seek tax exemptions on issuance of Islamic bond that “the trade account has been worsening and consequently, pressure is building on the balance of payments”.

Pakistan’s official foreign currency reserves - largely built by borrowings - have again started depleting after the end of the International Monetary Fund programme. As of April 14, the foreign currency reserves held by the central bank stood at $16 billion, a depletion of $2.4 billion since the IMF programme ended.

Government’s borrowing track

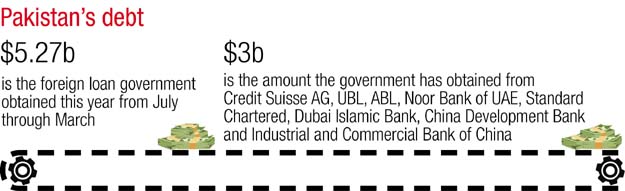

So far, the government has obtained over $3 billion from the Credit Suisse AG, United Bank Limited, Allied Bank Limited, Noor Bank of UAE, Standard Chartered, Dubai Islamic Bank, China Development Bank and Industrial and Commercial Bank of China, according to official documents.

Despite an overall low interest rate environment, the government’s interest payments are likely to increase in the coming years besides exposing it to the rollover risks. All these loans are for short periods and now the government is borrowing more to repay the previous debt, according to independent economists.

Pakistan obtained these short-term expensive loans from these banks between November 2013 and March 2017. These loans were obtained at an interest rate ranging up to 4.71% in dollar terms. Most of these loans were obtained on London Interbank Offered Rate (Libor) of three-month floating average plus 4%, which comes to around 4.71%. In one case, the loan was obtained at three-month floating Libor plus 3.25%, which translates into roughly 3.6%.

From July through March of this fiscal year, the government got $5.27 billion foreign economic assistance, according to the official documents. More than half of it was borrowed through unconventional sources like foreign commercial banks and issuance of $1 billion Sukuk bonds in September last year.

Pakistan to repay $6.5b debt over next 15 months

The government has estimated receiving $8 billion in foreign economic assistance during the current fiscal year 2016-17 and borrowings during first nine months were two-thirds of the annual estimates.

The government is expected to borrow another $750 million from China to pay back $750 million to Eurobond investors.

From July through March, Pakistan also got $1.1 billion project loans from China, which was exclusive of money obtained for balance of payments support. The project loans from China during the first nine months were 180% of the annual projection of only $565 million.

There is a clear shift in borrowing sources and pattern as in recent years Pakistan’s reliance on China has significantly increased.

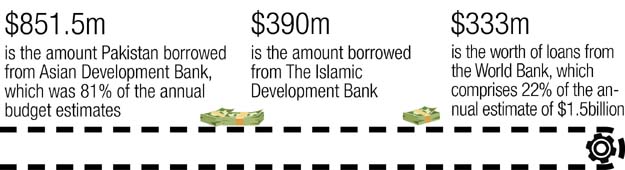

Pakistan also borrowed $851.5 million from Asian Development Bank (ADB), which was 81% of the annual budget estimates. The government is also trying to get another $600 million from the ADB before end of this fiscal year.

The loans from the World Bank stood at only $333 million or 22% of the annual estimates of $1.5 billion. The Islamic Development Bank gave $390 million, largely commercial borrowing for crude oil payments.

Published in The Express Tribune, April 28th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ