Pakistan to set up $1b infrastructure bank

IMF, other global institutions will have shares in the bank

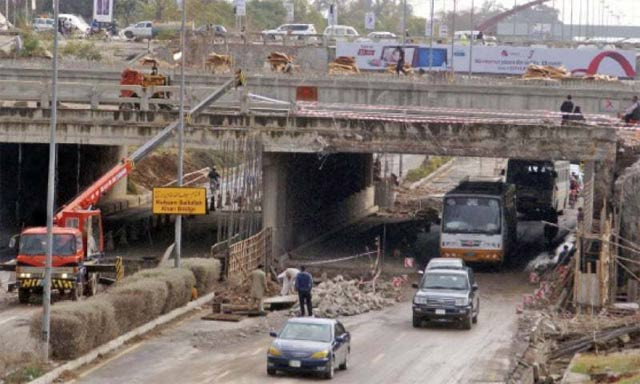

IMF, other global institutions will have shares in the bank. PHOTO: INP/FILE

Pakistan government and the International Monetary Fund (IMF) would have 20% shares each in the bank and the rest would be held by global organisations such as the International Finance Corporation, he said.

AJK plans tourism corridor along CPEC

He was speaking at a briefing held for the Pakistani media towards the end of his visit to Washington DC during which he attended spring meetings of the IMF and the World Bank.

Dar also revealed that the government would soon be launching Pakistan Development Fund (PDF) and its shares worth Rs100 billion would be offered to Pakistani diaspora in order to channelise their remittances effectively.

Later, these shares will be listed on the Pakistan Stock Exchange. “After the success of Sukuk (Islamic bonds), the PDF will be another attractive investment for overseas Pakistanis,” he remarked.

Giving a detailed round-up on the plenary sessions with the IMF and World Bank, the minister said there was positive sentiment about the tremendous economic rebound experienced by Pakistan over the last four years.

“Pakistan was on the verge of bankruptcy in 2014 and today it is likely to achieve approximately 5% growth during the current financial year,” he said. “Both IMF and World Bank are on the same page with the Pakistani government in these projections.”

Promotion of it: Work on innovation centres begins

Global credit rating agencies have upgraded the rating of Pakistan from negative to stable and from stable to positive in the last four years to an extent that the country is likely to be included in G-20 countries by 2030.

Published in The Express Tribune, April 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ