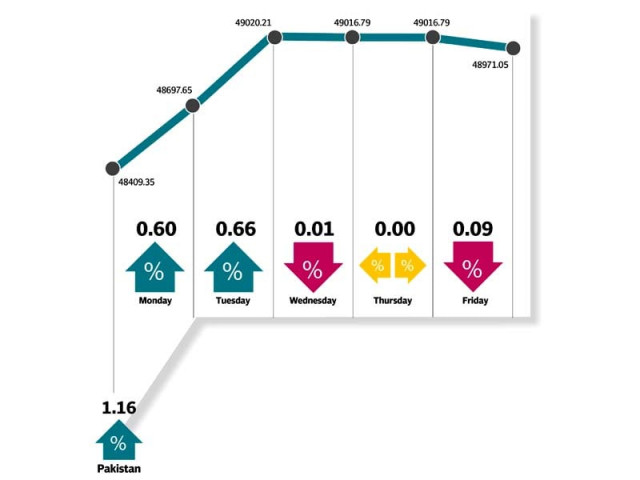

Volumes rise, KSE-100 up 1.2% as jitters start to fade

Index ends at 48,971 amid gains across sectors

Index ends at 48,971 amid gains across sectors.

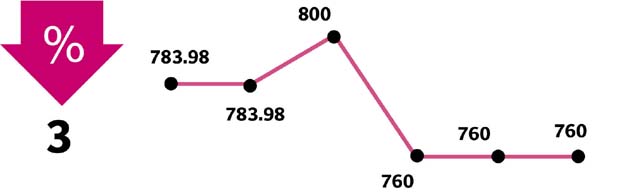

The KSE-100 Index closed the week at 48,971, up by 1.2 per cent or 562 points week-on-week.

K-Electric Limited (KEL) was the stock to watch, as National Electric Power Regulatory Authority (Nepra) reduced average electricity tariff for KEL by Rs3.50/unit for the next seven years, while also doing away with its service’s monopoly.

However, it also revised KEL’s benchmark T&D losses curve. KEL’s management termed the new multiyear tariff as detrimental to long-term investment and is expected to file a review petition.

Smaller sectors such as glass & ceramics and pharmaceuticals were in the limelight during the week, outperforming the KSE-100 index by 6.7 per cent week-on-week and 5.4 per cent week-on-week, respectively.

KSE-100 Index ends flat, but trading volume rises

Steel stocks blipped on the radar; with Aisha Steel Limited standing out to return 21 per cent week-on-week hitting its upper circuit four sessions in a row.

Among pharmaceuticals, GlaxoSmithKline (up 4 per cent week-on-week) was in the limelight, rallying on commencement of trading of its consumer arm, GlaxoSmithKline Consumer Healthcare (GSKCH), following its demerger with the pharmaceutical division.

Additionally, ground-breaking ceremony of Hub Power Company’s (HUBC) 1,320 MW imported coal project China Power Hub Generation Company (CPHGC) was held during the week.

Fertiliser numbers released by National Fertilizer Development Centre for February 2017 showed 18 per cent year-on-year decline in urea off-take. As a result urea inventory levels rose to 1.19 million tons. On the macro front, LSM grew by 3.48 per cent year-on-year in 7MFY17. Furthermore, country’s Current Account Deficit (CAD) surged by 120 per cent year-on-year to $5.4 billion.

Foreigners were net buyers of $3.5 million during the week as against selling of $11.1 million in the previous week.

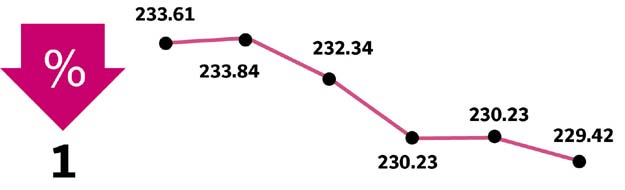

Week-on-week: SPI falls 0.14%

Major buying was seen in oil marketing company sector ($2.7million) and fertiliser ($2.3 million) while major selling was seen in cements for the second week running ($4.4mn).

Average volume traded increased by 38.9 per cent week-on-week, while average value traded decreased by 7.6 per cent week-on-week.

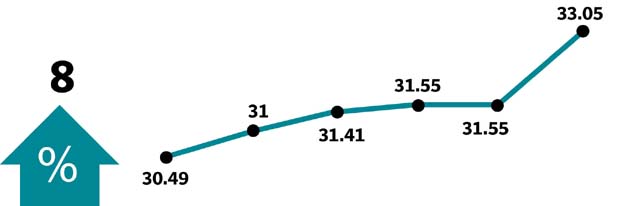

Winners of the week

The Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial

banking services.

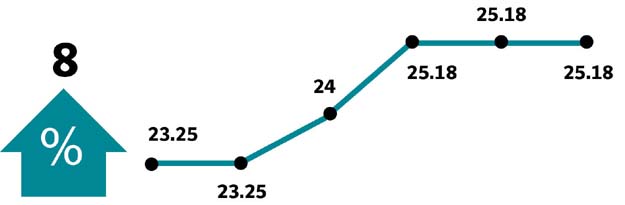

Saif Power Limited

Saif Power Limited is a project of Saif Group, which is a diversified industrial and services conglomerate with portfolios in textiles, power generation, oil & gas exploration, information technology & software development, real estate, fibre optic network, environmental management and healthcare services.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

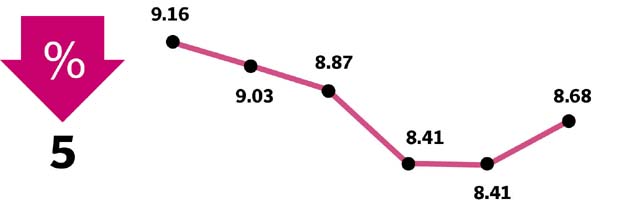

Losers of the week

K-Electric Limited

K-Electric Limited is a Pakistan-based company engaged in the generation, transmission and distribution of electric energy to industrial and other consumers.

Indus Dyeing

Indus Dyeing & Manufacturing Company Limited manufactures

and sells yarn.

United Bank Limited

United Bank Limited provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Published in The Express Tribune, March 26th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ