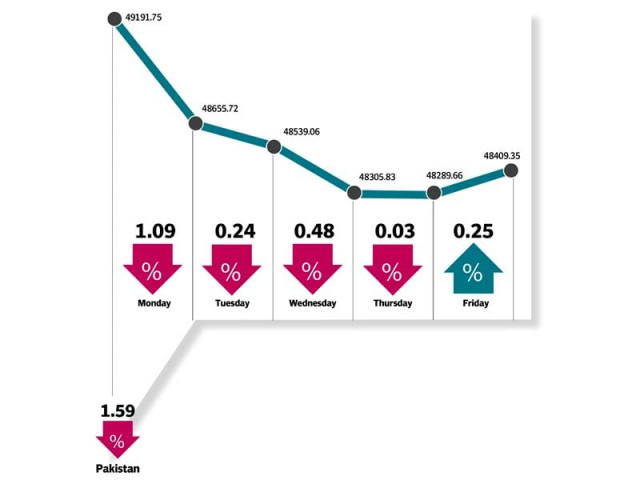

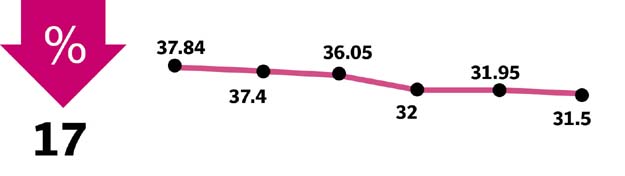

Weekly review: Index tumbles 1.6% as political uncertainty looms

Benchmark index closes at 48,409.35; banks, oil lead decline

Benchmark index closes at 48,409.35; banks, oil lead decline

Clouds of negative sentiment and scepticism loomed over the bourse as investors set their eyes on the outcome of the Panama case with falling crude oil prices proving to be another mood dampener.

Major drags on the index were Pakistan Petrol Limited (-7% week-on-week), Oil and Gas Development Company (-4.8%), United Bank Limited (-3.3%), MCB Bank (-4.9%) and Fauji Fertilizer Company Limited (-2.6%), with combined negative contribution of 370 points.

Oil stocks declined as crude oil price touched a low of $47.09/bbl, while banks declined due to concerns over inflation outlook and flattish profitability.

On the sector front, capitalisation of exploration and production’s declined 4.7% week-on-week, while banks and fertiliser declined 2.4-2.1%.

Some positive support was provided by Colgate-Palmolive Limited (+14 points), Cherat Cement Company Limited (+13 points), Meezan Bank Limited (+12 points), DG Khan Cement (+11 points) and Fatima Fertilizer Company Limited (+11 points), however, their impact was marginal, with a contribution of just 63 points to the index.

Habib Bank Limited’s traded volume witnessed a 10-year high of 15.6 million shares on the last trading session of the week, on the back of addition to the Global Equity Index Series Asia Pacific of FTSE.

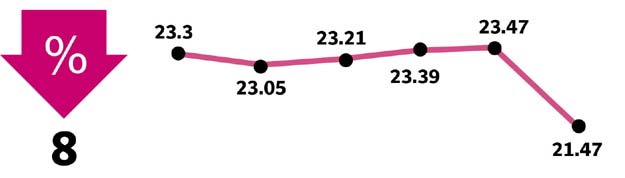

Average trading volumes declined from 238 million shares to 186 million shares (-22% week-on-week). Activity was focused in retail favourite stocks, which included K-Electric (100 million), Bank of Punjab (63 million), TRG Pakistan (43 million), Aisha Steel Limited (38 million) and Sui Northern Gas Pipeline (36 million).

Foreign Institutions ($11.08 million), individuals ($4.49 million), banks ($3.9 million) and mutual funds ($2.35 million) were net sellers during the week, while companies ($16.86 million) and non-banking financial company (NBFC ($0.32 million) were net buyers.

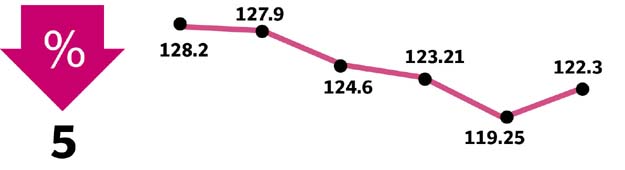

Foreigners were net sellers of $11.1 million during the week as against buying of $15.4 million during the previous week.

Winners of the week

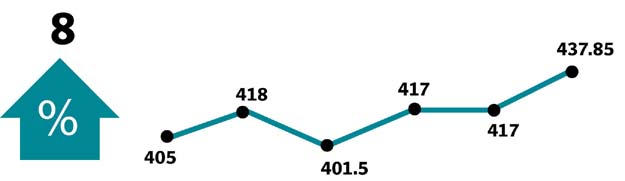

Pak Int Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

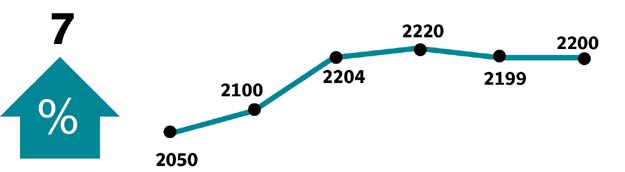

Colgate-Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

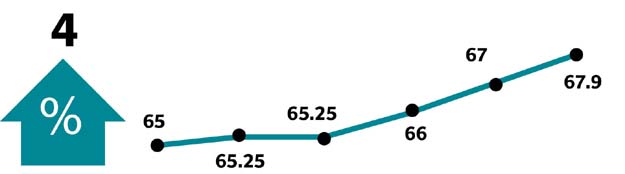

Meezan Bank

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans and other products through offices located throughout Pakistan.

Losers of the week

Habib Metro Bank

Habib Metropolitan Bank Limited is a fully accredited commercial bank. The bank provides banking services to individual and corporate customers including personal loans, education loans, mobile banking, cash management services, short & long-term financing, international trade and savings accounts.

Faysal Bank

Faysal Bank Limited provides commercial, consumer and investment banking services.

Ghani Glass

Ghani Glass Limited manufactures and sells glass containers. The company manufactures international glass containers for pharma, food and beverage. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

Published in The Express Tribune, March 19th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ