Farmers borrow at ‘much higher rates than industrialists’

NA panel asks government to end discrimination, requests NAB to file reference in Rs18.5 billion NBP scam

PHOTO: EXPRESS

The National Assembly Standing Committee on Finance and Revenue also decided to write a letter to the anti-graft watchdog chairman over the delay in filing a corruption reference against National Bank of Pakistan’s (NBP) former and current top officials, who were allegedly involved in a Rs18.5-billion credit scam.

‘Pakistan lags far behind in agriculture’

Committee members unanimously requested the National Accountability Bureau (NAB) chairman to put his signature on a reference awaiting approval since September 2016, which may eventually seal the fate of half a dozen top bank executives.

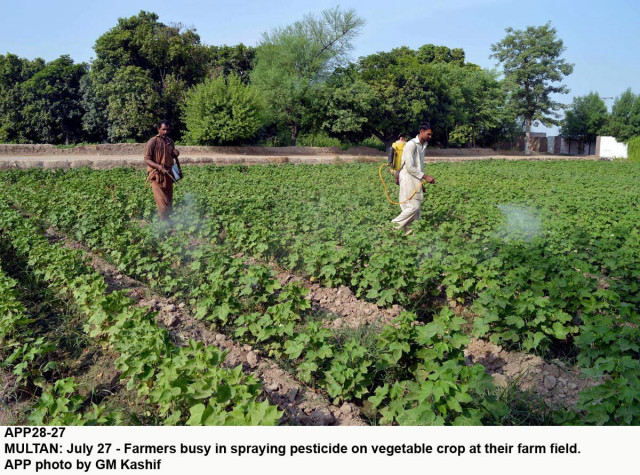

Agriculture sector

The National Assembly members came down hard on the government for ignoring the agriculture sector that had been brought to its knees in the past three and a half years due to adverse policies and plunge in commodity prices in the global market.

They approved a resolution, asking the federal government to bring down interest rates on agriculture loans, which currently ranged from 13.8% to 18%, to single digit.

Contrary to that, the industrial sector was borrowing in the range of 6.5% to 7.5%, according to the committee members.

“What kind of government is this that is extending loans to the agriculture sector at 13.8% when key policy rate of the State Bank of Pakistan (SBP) is just 5.75%,” asked Rana Mohammad Hayat of the Pakistan Muslim League-Nawaz (PML-N), an MNA from Kasur. If the cost of borrowing was not brought down, the committee members would lodge protest against the government and banks, he cautioned.

Zarai Taraqiati Bank Limited (ZTBL) was compelled to give agriculture loans at 14% interest due to its high cost of capital, revealed Syed Talat Mahmood, the bank’s president.

He said the SBP had given Rs56 billion in loans to ZTBL at 7.5% and in addition to that the bank’s administrative cost stood at almost 5%.

“ZTBL was subsidising the finance ministry by charging higher interest from the farmers,” claimed Pakistan Tehreek-e-Insaf’s MNA Asad Umar.

NBP scam

The parliamentary panel expressed its dissatisfaction over “slow progress” in investigation into the case in which NBP officers were accused of abusing powers in the processing and sanctioning of credit limits, willfully avoiding proper valuation of securities offered by the borrowers and causing losses of $185 million to the national exchequer.

Problems riddle agriculture sector, say experts

“NAB investigation is complete and it is a matter of a couple of weeks before the chairman approves the reference for sending it to the accountability court,” Zahir Shah, NAB Director General Operations, told the committee.

However, it was the fourth deadline that NAB had set. Last month, its officials told the standing committee that the reference would be approved within two days.

Shah pointed out that a legal question about Bangladeshi borrowers, who were residents of another country, became one of the reasons behind the delay.

At the management level, he said, NAB had decided that it would proceed only against its employees, whether they were Pakistanis or Bangladesh nationals.

“We feel that NAB is reluctant to move against powerful people,” observed Qaiser Ahmad Sheikh, Chairman of the standing committee.

NAB had launched an investigation into the conduct of Syed Iqbal Ashraf, who recently retired as NBP president, along with former NBP chief Syed Ali Raza and half a dozen senior executive vice presidents, NAB documents showed.

In addition to that, NAB also investigated the conduct of six Bangladeshi nationals.

The Express Tribune reported the fraud on January 1, 2014, which prompted the standing committee to take up the matter and refer it to NAB.

ACE reply sought in wheat spoilage case

NAB inquiry has named Zubair Ahmad, regional chief of Bahrain operations that also included Bangladesh, and QSM Jehanzeb, general manager, as the main accused.

Published in The Express Tribune, March 16th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ