The Federal Board of Revenue (FBR) will begin sending out notices to over 700,000 individuals on Monday, instructing them to obtain national taxpayer numbers (NTNs) and start paying taxes, said FBR chief Salman Siddiqui on Saturday.

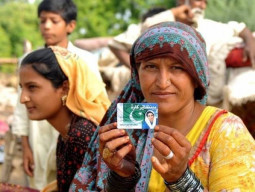

Siddiqui said that the FBR, in collaboration with the National Database and Registration Authority (NADRA), had identified 2.3 million individuals who were not registered with tax authorities and evading taxes. The FBR has obtained key information about tax dodgers including their addresses and photographs.

However, given the lack of adequate personnel at the FBR, they will begin pursuing cases against a short-list of evaders.

“FBR is not a huge organisation so we cannot go after everyone at once,” said Siddiqui. “We have decided to prioritise recovery from 700,000 individuals because these are people who have considerable incomes and are still not paying their dues.”

The FBR will give a month to these individuals to obtain their NTNs, following which, if they have failed to begin paying taxes, further action against them will be taken.

“Initially we will adopt a facilitative attitude so that these people are encouraged to come clean but after this term expires, the FBR will prosecute these people under the relevant laws,” warned the FBR chairman.

Salman Siddiqui and a team of FBR officials arrived in Karachi on Friday to consult with businesses and other stakeholders regarding the upcoming federal budget. However most of their time here has been taken up deliberating over changes in taxes announced on March 15th, 2011. Through a series of statutory regulatory orders, the FBR has repealed tax exemptions for a variety of companies and goods.

Addressing the concerns of the business community over these tax increases, Siddiqui said that the finance minister would also be coming to Karachi to address these matters.

Corporate taxes to go down

The FBR chairman revealed that the government was considering lowering the corporate income tax rates. At 35 per cent, Pakistan’s corporate tax rates are among the highest in the world, though many corporations are able to claim exemptions and reduce their effective tax rate.

“Corporate tax rates should be lowered in phases within 3 to 5 years,” said Siddiqui, adding that the proposal would be part of the upcoming budget.

The chairman pointed out that a much more structural approach was needed to address the government’s chronic fiscal deficits. “Implementation of reformed general sales tax is one of the steps in this direction,” said Siddiqui.

Published in The Express Tribune, March 20th, 2011.

1731494851-0/BeFunky-collage-(51)1731494851-0-405x300.webp)

1731487683-0/Copy-of-Untitled-(35)1731487683-0-270x192.webp)

1731489300-0/Copy-of-Untitled-(36)1731489300-0-270x192.webp)

COMMENTS (9)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ