Weekly review: KSE sheds 3.6% amid foreign selling

Foreign selling was witnessed in the Karachi bourse which resulted in a setback for the market.

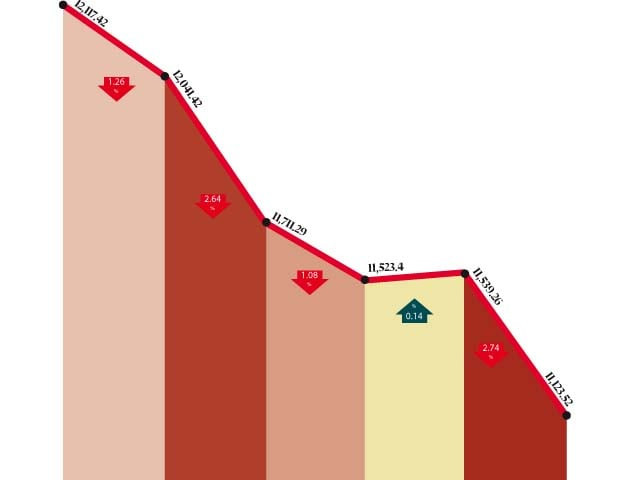

Foreign selling was witnessed in the Karachi bourse which resulted in a setback for the market, as the KSE 100-share index shed 3.6 per cent, or 439 points, during the week ended March 18.

Foreign interest, already hampered by the ongoing political crisis in Libya and the Middle East, was dampened further by the catastrophic earthquake in Japan, the third largest economy of the world.

The earthquake and the subsequent tsunami crippled Japan, resulting in its markets shedding 11 per cent. Regional markets also fell sharply as a result, with foreigners divesting their investments.

Foreigners pulled out a net $16 million from the Karachi market during the week, following $6 million withdrawn in the preceding week. The trend of foreign outflow can be expected to continue as the situation in Japan and the Middle East evolves.

The week was also witness to several significant events, although they failed to generate interest in the market.

Primary amongst those was the resolution of the Raymond Davis case. The US national was finally released by Pakistani authorities after payment of blood money to the victims’ families, bringing an end to the bone of contention in Pakistan-US relations. However, the positive impact of this event was not very significant, as protests by political and religious parties broke out following the release.

The second important event was the reintroduction of the Margin Trading System (MTS) and Margin Financing System (MFS). Much hype had been built leading up to the implementation of the system, but its positive impact was not obvious.

Investors were careful not to take a plunge into margin trading immediately and were still exploring the pros and cons of the system, as final guidelines were unveiled only in the previous week. MTS investments stood at Rs25.7 million at an average financing rate of 19.94 per cent.

The government also announced new taxation measures during the week via presidential ordinances to generate more revenue and bridge the fiscal deficit. The ordinances brought into force 15 per cent flood tax which will hit corporate earnings, thus having a negative impact on the market.

Average daily volumes improved by 27 per cent to 112 million shares as investors were cautious, while average daily value improved only by 13 per cent, showing that activity skewed towards second and third tier stocks. The KSE-100 index’s market capitalisation fell 3.9 per cent to Rs3.11 trillion during the week.

What to expect?

The flow of foreign funds can be expected to set the tone of the market in the coming week. With the Japanese crisis worsening, more foreign outflow can be expected, resulting in a negative impact on the market.

The State Bank of Pakistan is also expected to announce monetary policy on March 26 and the consensus is that it will maintain status quo, as the previous month’s inflation numbers were significantly reduced.

Finally, as investors come to grip with MTS and MFS, trading activity can be expected to gradually grow in coming weeks. Yet, miracles should not be expected as this change will take time to set in.

Monday, March 14

The market witnessed little change despite the much-awaited Margin Trading System marking its first day at the bourse. Political uncertainty overshadowed the introduction of margin trading, as investors remained confused about the fate of the relationship between Pakistan Peoples Party and Muttahida Qaumi Movement.

Tuesday, March 15

The market plunged as the bourse felt regional market tremors on the back of concerns of radiation leaks from a nuclear plant in Japan following a massive earthquake. Japanese concerns hammered world stocks to their lowest point in nearly three months.

Wednesday, March 16

News of imposition of new taxes did not go well at the stock market on Wednesday, as investor interest remained low throughout the session. The government announced an additional 15 per cent flood surcharge, coupled with 17 per cent sales tax on fertilisers.

Thursday, March 17

The market recorded bullish activity after the release of Raymond Davis, a US citizen accused of killing two Pakistanis on January 27, which increased expectations of improved relations between Pakistan and the US.

Friday, March 18

The market witnessed massive selling by foreigners, particularly in oil stocks, pushing down the bourse.

Published in The Express Tribune, March 20th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ