SNGPL leaps from loss to profit in 1HFY17

Earns Rs3.6b following 35% rise in gas sales value

PHOTO: FILE

The gas utility had booked a net loss of Rs215.46 million in the same half of the previous year.

Accordingly, earnings per share (EPS) came in at Rs5.68 in Jul-Dec 2016-17 compared to loss per share of Rs0.34 in the corresponding period of financial year 2015-16.

Its share price rose 2.33%, or Rs2.50, to Rs109.39 with a volume of 5.97 million shares at the Pakistan Stock Exchange.

According to the profit and loss account, the company’s gas sales increased 35% to Rs151.94 billion in Jul-Dec FY17 compared to previous year’s Rs112.48 billion.

Other income, mainly stemming from the late payment surcharge paid by gas consumers, increased 53% to Rs6.65 billion from Rs4.35 billion. Selling cost dropped 28% to Rs2.39 billion from Rs3.34 billion.

On the flip side, finance cost swelled 21% to Rs2.97 billion from Rs2.44 billion.

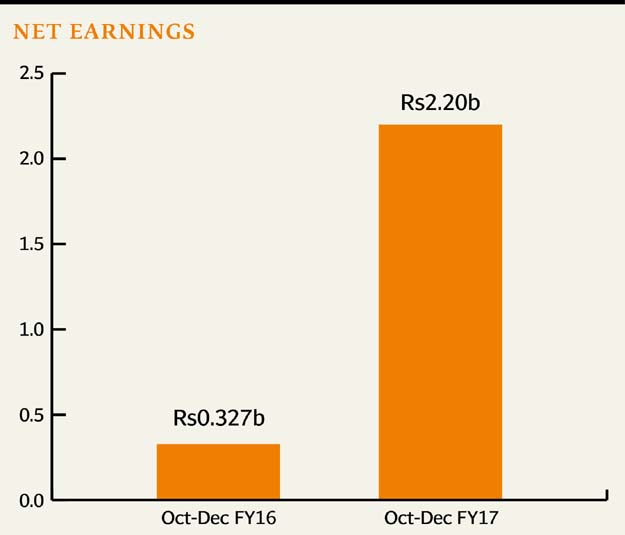

In the second quarter (Oct-Dec) alone, the net profit soared sevenfold to Rs2.20 billion (EPS Rs3.47) from Rs327.97 million (EPS Rs0.52) in the corresponding quarter of FY16.

Topline Securities, in its post-result comments, said the strong profitability in a single quarter was primarily the outcome of higher operating profits, which were linked with increased capital expenditure.

“SNGPL has been undergoing major capex [capital expenditure] on an LNG [liquefied natural gas] pipeline scheduled to be completed by the end of FY17,” it said.

SNGPL is estimated to undertake capital spending of over Rs30 billion in the current financial year. “SNGPL earns a fixed 17.5% return on its operating assets, which results in higher operating profits,” Umair Naseer, an analyst at the brokerage firm, said.

Unaccounted-for-gas (UFG) loss has been on the decline, driving the company’s net profit. “UFG in 2QFY17 is estimated at 8% against over 9% in the same period of last year,” he added.

Published in The Express Tribune, February 23rd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ