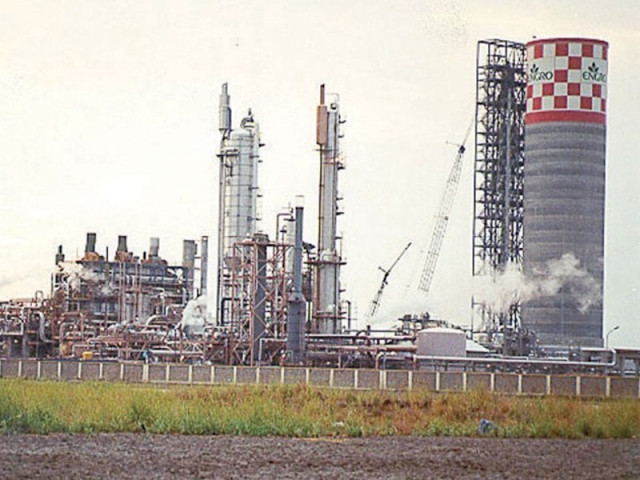

Corporate result: Engro Fertilizers posts profit of Rs9.3b, down 37%

Earnings per share decline to Rs6.98 in 2016 compared with EPS of Rs11.14 in 2015

Earnings per share decline to Rs6.98 in 2016 compared with EPS of Rs11.14 in 2015 PHOTO: FILE

Earnings per share (EPS) declined to Rs6.98 compared with an EPS of Rs11.14 in the period under review.

On Wednesday, EFERT’s share price closed at Rs69.68, down 1.2%. The KSE-100 Index closed at 49,874, down 15 points or 0.03%.

The company’s revenue declined despite an uptick in Urea off-take (seasonality and government measures), which increased by 8% year-on-year.

Engro Fertilizers makes Rs2.9b profit in Q3

Low prevailing retention price in the domestic market on the back of discounts offered to push urea volumes upward kept net revenues of the company in check, according to a Topline Securities report.

Distribution cost grew by 45% year-on-year to Rs3.2 billion in the fourth quarter of 2016, which was higher than expectations given fertiliser off-take during the period and translated into operating profit of Rs2.3 billion in the fourth quarter of 2016 (down 24% year-on-year).

Other income, which includes subsidy on Urea of Rs156 per bag (under Kisan relief package) along with Rs300 per bag subsidy on Di-ammonium Phosphate (DAP) sales, was below expectations (based on off-take numbers for Urea and DAP for fourth quarter of 2016).

Fertiliser subsidy restored on PM's directive

This along with higher distribution costs contributed towards decline in bottom line of 32% year-on-year.

During 2016, revenue of EFERT posted a decline of 19% while gross margins declined by 10 percentage points to 25% (Gross Margin down 4 percentage points year-on-year after accounting for subsidy) due to a substantial fall in urea retention prices and decline in urea off-take (12% year-on-year for 2016).

DAP off-take jumped by 36% year-on-year for 2016, but failed to support profit due to low margin on imported stocks.

Key risks for company include short lived ramifications of the subsidy, imposition of Gas Infrastructure Development Cess (GIDC) on concessionary gas and lack of improving agronomics, the report added.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ