Weekly review: Landmark week for KSE-100

Benchmark index gained 1.2%, surpassed 50,000 but slid on last day due to profit-taking

Benchmark index gained 1.2%, surpassed 50,000 but slid on last day due to profit-taking

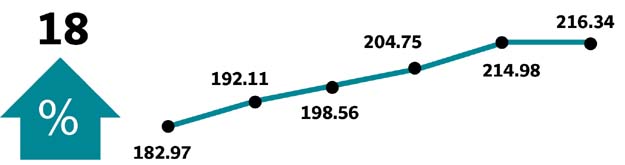

The KSE-100 index closed the outgoing week 1.2% higher at 49,964 points; even though profit-taking was witnessed during the last trading session as investors continue to monitor the ongoing Panama Papers case.

The investors also turned cautious ahead of the Monetary Policy announcement due over the weekend.

Nevertheless, the week marked a landmark event and gains were largely led by the enthusiasm/optimism of local investors on the back of strong domestic liquidity.

Apart from the opening day, the week remained range-bound as the market continued to absorb different sector specific news.

The Economic Coordination Committee’s decision to approve fertiliser subsidy along with export of 0.3 million tons of urea created hope that the industry’s inventory levels might reduce.

Hubco was the biggest contributor to the index, adding an impressive 147 points. The company’s announcement of exercising its option to increase its shareholding in China Power Hub Power Generation Company sparked interest in the stock.

TRG Pakistan was another major contributor to the index, adding 60 points as news of its international subsidiary, Affinity’s IPO, made rounds in the market.

K-Electric Limited emerged as the volume leader during the week, adding 60 points to the index with interest largely emanating from value hunting by investors prior to its public offer by Shanghai Electric.

Results announcements of some big stocks in cement, auto assemblers and oil sector came out during the week and were largely in line with market expectations. Overall, most of the activity during the week was witnessed in medium-tier stocks.

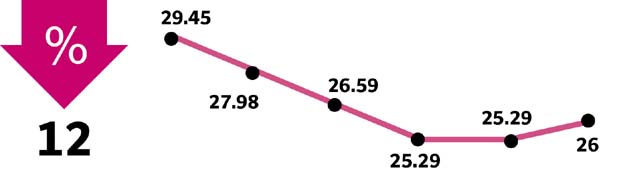

Foreigners remained net sellers, however, the quantum slowed down in the week under review. Foreigners sold $14 million worth of shares versus $47 million during the previous week.

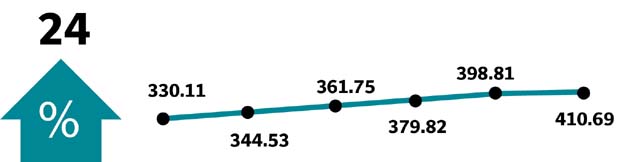

Average daily volumes swelled by 36% week-on-week, averaging 523 million shares.

Winners of the week

IGI Insurance

International General Insurance of Pakistan provides property and casualty insurance products and services. The company’s products include fire, marine and motor insurance.

Crescent Steel

Crescent Steel & Allied Products Limited manufactures steel lined pipes and multi-layer pipe coatings, which are used for water, oil and gas transmission. The company also has a cotton division that manufactures cotton yarn.

Orix Leasing

Orix Leasing Pakistan Limited is a leasing and diversified financial services company. The company offers full pay out finance leases for machinery, office automation, computers, vessels, aircraft and automobiles. Orix financial service products include loans, rentals, security brokerage, options trading and life insurance products.

Losers of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Soneri Bank

Soneri Bank Limited provides banking services.

Published in The Express Tribune, January 29th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ