Monetary policy: SBP keeps key interest rate unchanged at 5.75%

Central bank governor says challenges remain on external front

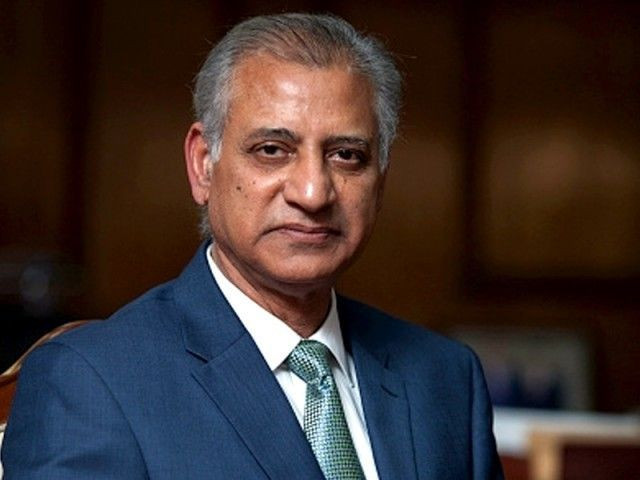

SBP governor. PHOTO: REUTERS

Revealing the monetary policy statement, which is announced once every two months, SBP Governor Ashraf Mahmood Wathra said the decision of maintaining the policy rate was taken after “tough debate” among members of the Monetary Policy Committee.

The central bank has maintained the rate since May 2016 and remains Pakistan’s lowest in over four decades.

Majority of the analysts argued that the rate had bottomed out and foresaw gradual upward revision going forward. The monetary policy rate was in double digits (at 10%) in the first half of fiscal year 2012-13.

“Growing China-Pakistan Economic Corridor (CPEC) related imports, decline in exports, absence of Coalition Support Fund and slowdown in remittances, pushed the current account deficit on the higher side,” said Wathra.

Monetary matters: SBP keeps policy rate unchanged at 5.75%

The deficit doubled to $3.6 billion in the current fiscal year’s first-half ended December 31, 2016 from $1.7 billion in the same period last year.

“Going forward, with...risks to the external sector, the need of financial inflows would grow further,” he said, adding that the higher deficit was financed by an increase in bilateral and multilateral funding along with pick up in investment flows.

The governor, however, presented the optimistic side. “The current account deficit has increased because of higher import of plants, machinery and projects equipment. The imports will help increase [industrial] production. This should be seen in a positive way.”

Excluding import of machineries, the deficit stood at “1.2% which is not much,” Wathra added.

He hoped that exports would revive after the government announced an export package worth Rs180 billion. He said Pakistan has received zero funds on account of Coalition Support Fund (CSF) in the current fiscal year against an expected receipt of $1.1 billion.

The CSF is US reimbursement against expenditure Pakistan has already incurred on war against terrorism.

The governor added that the slowdown in remittances - sent home by Pakistani living abroad - was seen after Middle Eastern and GCC economies came under pressure due to lower fuel oil prices and hardening of reimbursement laws in the US and UK. Saudi Arabia, Abu Dhabi, UK and US are big four sources of remittances to Pakistan, he said.

The depreciation in the UK currency (British pound) against the dollar has also impacted remittances to Pakistan. “People living in UK send remittances in British pound and we count them in dollar value,” he said.

Pakistan will suffer when US interest rates rise

Wathra projected remittances to amount to over $20 billion in the ongoing fiscal year. “They will be higher than last year,” he added.

Talking about average inflation, he said that it clocked at 3.9% during July-December 2016, lower than the earlier projections due to smooth supply of perishable items, stable exchange rate (interbank) and government’s absorption of the impact of higher international oil prices.

“The current trends suggest that the actual inflation would be lower than the target rate of 6% in FY17,” he said.

A sizeable net retirement of government borrowing to scheduled banks and an increase in bank deposits helped increase private sector credit.

Private businesses are actively borrowing from the banking sector for upgrading and expanding their business processes. They borrowed Rs375 billion in the first half of FY17 as compared to Rs282.6 billion availed in the corresponding period.

Demand for consumer financing, especially for auto loans, also gathered pace during the first half of the year, said the governor. Healthy credit expansion, along with higher production of Kharif crops, visible improvements in energy supply, and upbeat business sentiments signal recuperating real economic activities.

Large-scale manufacturing grew by 3.2% during the first five months of the current fiscal year and further increase is expected on account of growing infrastructure spending and recent policy support for export oriented sectors, Wathra added.

Published in The Express Tribune, January 29th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ