Suggestion: Accountancy firm proposes up to 20% tax on offshore assets

It is sharply higher than tax rates being discussed for an amnesty scheme

FBR chief says tax rates for non-filers of returns will be increased in FY18. CREATIVE COMMONS

The proposed rates for whitening offshore assets are significantly higher than the under discussion rates, although the firm supports the move to give the general tax amnesty scheme.

The proposal comes as Finance Minister Ishaq Dar has assigned tax authorities to work out a tax amnesty scheme to lure people to disclose their hidden assets in Pakistan and abroad.

Naveed Zafar Ashfaq Jaffery & Co, a chartered accountancy firm, has forwarded its proposal to the finance minister. The firm’s senior partner Ashfaq Tola has drafted the proposal.

However, the proposal is different from what the Federal Board of Revenue (FBR) is considering. The FBR shared the model of the Indonesian tax amnesty scheme with Dar last week.

Indonesia is charging different rates for local and offshore assets aimed at attracting the wealth stashed abroad. It charged halve of the announced rates on offshore assets.

The Senate Standing Committee on Finance has also recommended giving a general tax amnesty scheme.

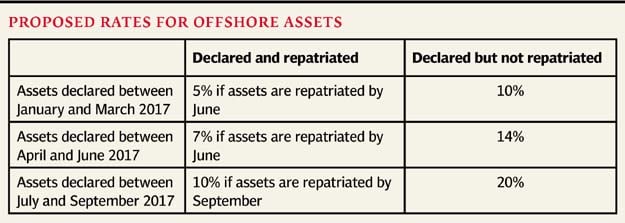

The chartered accountancy firm proposed that the government should charge 5% rate if the declaration of asset is filed between January 1 and March 31 next year and the assets are repatriated to Pakistan by June next year. However, if the beneficiary does not repatriate the assets, then the rate should be 10%.

Pakistan currently suffers from fiscal constraints with one of the lowest tax-to-GDP ratios in the world and the government has failed to broaden the tax base. As of December 22, only 779,000 people had filed income tax returns for tax year 2016, down from last year’s 1.074 million.

According to the chartered accountancy firm, if the beneficiary of the scheme files the declaration of assets between April and June 2017 and brings back the assets by June 2017, the normal rate should be 7%. In case, the beneficiary does not repatriate the assets, he will have to pay a 14% rate.

If the declaration of assets is filed between July and September 2017 and the assets are repatriated by September next year, then the rate should be 10%. In case of non-repatriation, the rate must go up to 20%.

The proposed scheme will inject a fresh blood into the documented economy not only in the year of its implementation but also in the coming years as the income generated each year on the assets declared will be charged to tax, said the firm.

After the world has started embracing the principles of transparency, it will become increasingly difficult for people to retain untaxed assets even in offshore tax havens.

According to some estimates, Pakistanis have about $100 billion to $120 billion worth of assets abroad, although Finance Minister Ishaq Dar had once quoted a $200 billion figure. Even 5% of this amount would significantly lessen the government’s fiscal woes.

Barring difference in the rates, almost all the major stakeholders have unanimous views on the need of having a tax amnesty scheme, although the scheme will have moral hazards.

After Panama and Bahamas leaks in which more than 600 Pakistanis were named, not even one person has been brought to justice to date. The FBR’s efforts are restricted only to the extent of serving tax notices to them.

The FBR’s tax laws provide safe passage to even those who evade and avoid taxes. Currently, the FBR can open up to five-year-old cases of a taxpayer and up to ten-year-old cases in case of non-filers of income tax returns.

The firm has also proposed that the government should introduce restrictions on free flow of dollars abroad by Pakistanis. It has proposed that like India, Pakistan should also cap outflow of dollars by an individual at $500,000 a year. Moreover, 100% penalties may be imposed on transfer of moneys through informal channels.

Published in The Express Tribune, December 31st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ