Market watch: Index-heavy stocks lead the way, KSE-100 ends at record high

Benchmark KSE 100-share Index gains 504.16 points

PHOTO: AFP

Oil, cement and banks provided the early impetus with fertiliser scrips also coming in the limelight after impressive figures of urea sale for the month of November, extending enough support to an already bullish market.

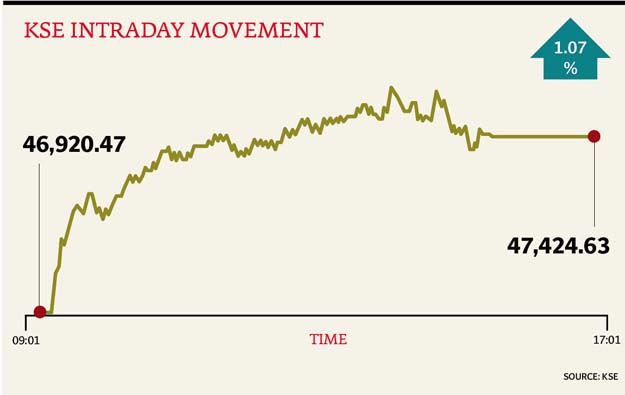

At close on Wednesday, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index finished with a rise of 1.07% or 504.16 points to end at 47,424.63.

Elixir Securities analyst Ali Raza said Pakistan equities staged a surprising rally as institutional buying emerged that pushed benchmark KSE100 index to a new all-time high over 47,400 level.

“Market opened on a positive note with index heavy oils providing early support as investors tracked continued rise in global crude,” said Raza.

“Thereafter, institutional flows in index names helped keep the momentum going with a number of stocks rallying and supporting the Index ride.

“Index heavy MCB Bank (MCB,+2.3%) and Habib Bank (HBL,+1.1%) stood out as star performers as they cumulatively contributed nearly one-fifth points to KSE100 Index. While other notable blue-chips such as Engro Corp (Engro, +2%), Pakistan Petroleum (PPL, +1.5%), Lucky Cement (LUCK, +1.1%) and DG Khan Cement (DGKC,+2.2%) also landed themselves among top ten stocks on the leader board.”

Fertilisers also came in limelight and traded higher as investors cheered provisional release of higher-than-expected urea offtake in November, said Raza.

JS Global analyst Nabeel Haroon said market extended its previous day gain as the index surged around 504 points.

“Investor interest was seen in the cement sector on the back of investor anticipation that there will be a year-on-year growth in cement dispatch numbers for the month of December, due to be released by All Pakistan Cement Manufacturers Association in the coming week.

“Exploration and production sector gained as crude oil prices surged to trade above $54/bl level less than a week before major global oil producers begin to scale back production by 1.8 million barrels a day, as per the deal struck in the last OPEC meeting in Vienna.”

Trading volumes rose to 273 million shares compared with Tuesday’s tally of 198 million.

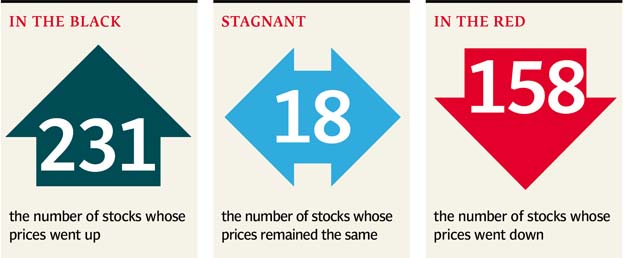

Shares of 407 companies were traded. At the end of the day, 231 stocks closed higher, 158 declined while 18 remained unchanged. The value of shares traded during the day was Rs16.4 billion.

K-Electric Limited was the volume leader with 21.9 million shares, gaining Rs0.05 to finish at Rs9.25. It was followed by Dewan Cement with 18.9 million shares, gaining Rs1.78 to close at Rs39.01 and Bank of Punjab with 13.4 million shares, losing Rs0.02 to close at Rs17.56.

Foreign institutional investors were net sellers of Rs563 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 29th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ