Weekly review: Profit-bookers step in to halt three weeks of bull run

KSE-100 index gained 0.1% week-on-week, closing at 46,633 points

KSE-100 index gained 0.1% week-on-week, closing at 46,633 points

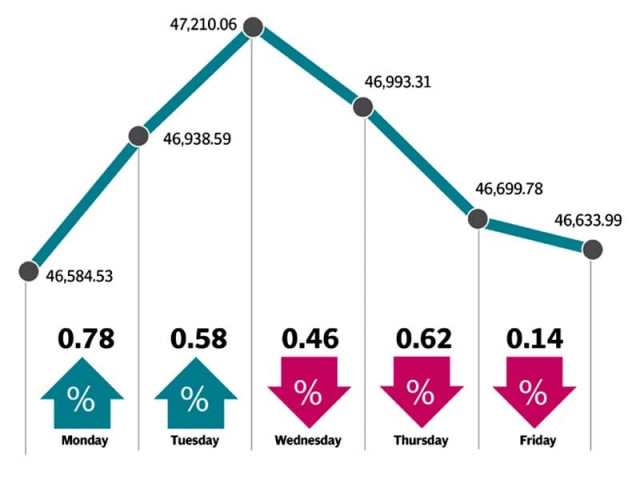

After an impressive rally of 3,500 points over the previous 3 weeks, the benchmark index took a breather, closing at 46,633 points, up just 0.1% week-on-week.

However, one of the major developments during the outgoing week was the successful completion of the bidding process for a 40% stake sale of the Pakistan Stock Exchange (PSX) that went to a Chinese consortium.

The consortium won the majority bid for a 30% stake while Pak-China Investment Company Limited and Habib Bank Limited picked up 5% each.

Whilst the news did little to stir equity prices in the trading sessions following the announcement, this marked the start of a new chapter in Pakistan’s equity market as strategic sale is expected to open new doors of growth opportunities going forward. The week started on a positive note as the KSE-100 index breached the 47,000 slab on Tuesday where it touched highest ever level of 47,201 points.

However, investors remained cautious in the latter days of the week where profit booking and subdued volumes kept the rally in check, causing the index to lose 360 points or 0.6% since Wednesday. Oil remained strong throughout the week, however, a technical correction led the index to close the week marginally lower, resulting in mixed activity. Oil exploration and production companies (E&Ps) performed on the back of rising oil prices. Investors’ interest was also seen in financial sector, searching for year-end dividends as the result season approaches.

Habib Bank Limited (+159.7pts), Habib Metro Bank (+44.6pts), Bank AL Habib Limited (+36.2pts) and Bank Alfalah (+34.2pts) secured their position as the top 5 index movers. Textile stocks performed due to November 2016 export numbers indicating a 9.71% year-on-year increase in textile exports. Nishat Mills Limited and Kohinoor Textile Mills were among the top performers for the sector.

Local mutual funds on the other hand continued to absorb hefty selling amidst hefty liquidity inflows ($21 million worth of equities bought during the week).

Average daily volumes declined by 6% week-on-week, averaging 337 million shares.

Foreigners ($ 44.38 million), Banks & DFIs ($1.74 million) and Companies ($8.16 million) were net sellers while mutual funds ($2.7 million) and individuals ($5.34 million) remained net buyers.

Published in The Express Tribune, December 25th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ