Expensive Eurobond issue has no early return clause

Govt borrowed Rs570b in 2-1/2 years by keeping motorways, airport as collateral

PHOTO: EXPRESS

In a written reply to the upper house of parliament, the minister also revealed that the government had borrowed roughly Rs570 billion in the past two and a half years from international and domestic markets by keeping two motorways and the Jinnah International Airport, Karachi, as collateral.

“The terms of the $500-million Eurobond issued in 2015 did not provide the option of paying the debt early,” according to the reply submitted in the Senate.

It came in response to a question from Pakistan Peoples Party (PPP) Senator Osman Saifullah Khan whether the government had the choice to return the debt before its maturity due to the high interest rate.

In September 2015, the PML-N government had issued the $500-million Eurobond at the high rate of 8.25%, drawing criticism from the quarters concerned.

In September this year, it also raised $1 billion by floating Sukuk (Islamic bonds) at an interest rate of 5.5%, one of the lowest rates on the country’s sovereign bonds.

Last month, Finance Secretary Dr Waqar Masood told the Senate Standing Committee on Finance that Pakistan had got $2.5 billion worth of offers, but it accepted only $1 billion at 5.5% return.

The early repayment option would have allowed the government to return the expensive debt before its maturity, said Saifullah Khan while talking to The Express Tribune.

Had the option been included in the bond structure, the government would have raised $1.5 billion this September to return the previous expensive debt, he elaborated.

The structure of Sukuk is such that the government has to offer collateral against borrowings, which results in relatively low interest rates compared with conventional borrowing sources like Eurobond.

The government has borrowed $4.5 billion by issuing bonds in international debt markets over three and a half years.

However, the early repayment clause is not very common in sovereign deals as investors prefer to place funds for longer durations in the hope of receiving better returns.

The borrowing of Rs570 billion in the past two and a half years from international and domestic debt markets through Sukuk included $2-billion bond issues in the global market, Dar said.

This also came in response to Khan’s query about the collateral that the government had kept for acquiring loans.

The government put sections of the Lahore-Islamabad Motorway, Faisalabad-Pindi Bhatian Motorway and Jinnah International Airport as collateral to obtain the loans, according to Dar.

The Fiqh Academy of the Organisation of Islamic Cooperation (OIC) had legitimised the use of Sukuk in February 1988, prompting Pakistan to issue its first Ijara Sukuk in 2005, he said.

The Eurobond was issued under an implicit sovereign guarantee whereas in Ijara Sukuk the underlying assets were utilised, the minister said.

In December 2014, the government raised $1 billion against Islamabad-Chakwal section of the M2 motorway. In October 2016, it again raised $1 billion from international debt markets by pledging Hafizabad-Lahore section of the M2 motorway.

Domestic Sukuk

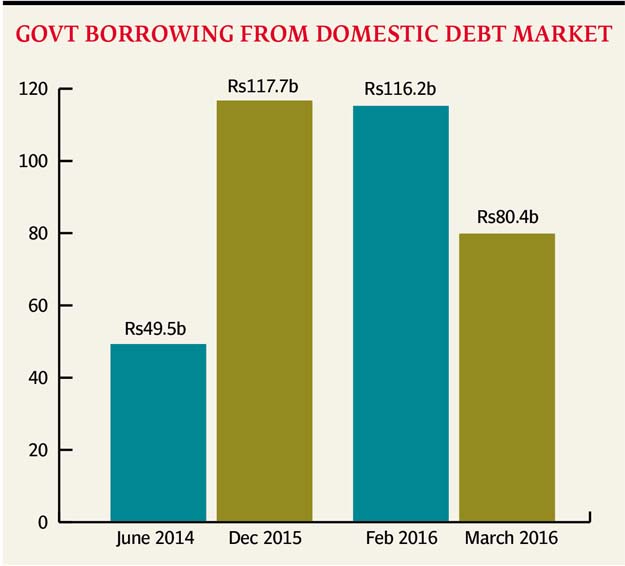

In June 2014, the government borrowed Rs49.5 billion by keeping the Faisalabad-Pindi Bhatian Motorway (M3) as collateral. In December last year, it borrowed Rs117.7 billion against the Jinnah International Airport. In February this year, it again raised Rs116.2 billion against the airport.

In March 2016, the government borrowed another Rs80.4 billion against the airport, according to the finance minister. “No revenue stream has been pledged or securitised for obtaining the loans,” he said.

Over the past three and a half years, the government has been on a borrowing spree to meet its budget financing needs. A recent report of the International Monetary Fund revealed that Pakistan’s external debt was primarily increasing because of government’s inability to enhance exports and attract foreign direct investment.

Pakistan’s total debt and liabilities stood at Rs22.4 trillion as of June this year, according to the State Bank of Pakistan.

Published in The Express Tribune, December 23rd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ