Market watch: Foreigners offload, but index continues positive ride

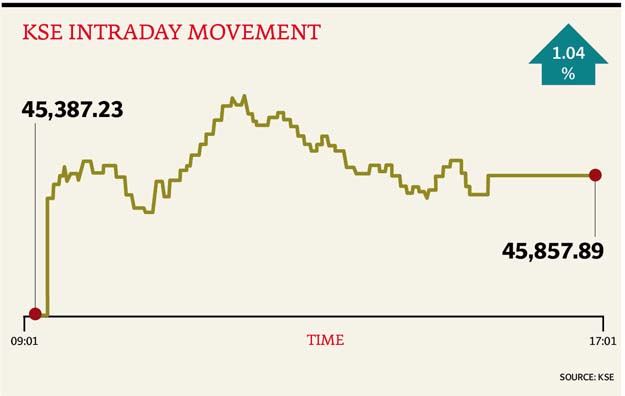

Benchmark KSE 100-share Index rises 1.04%

PHOTO: EXPRESS

Spurred by higher price of crude oil that gained on the back of the weekend OPEC meeting, Pakistan equities too, jumped on the bullish ride that has engulfed global markets.

At close, the PSX’s benchmark KSE 100-share Index finished with a rise of 1.04% or 470.66 points to finish at 45,857.89. Elixir Securities analyst Faisal Bilwani said equities carried the bullish momentum into the new week with benchmark KSE100 index closing positive and adding near 7.5% in the last two weeks alone.

“Market opened gap up led primarily by exploration and production that tracked sharp gains in global crude over the holidays after OPEC-Russia supply cut agreement went through,” said Bilwani.

“Index heavy oil and gas development (OGDC, +4.1%) topped the leaders board and traded most volumes in last seven years, while rest of the listed E&Ps namely Pakistan Oilfields (POL, +5%), Pakistan Petroleum (PPL, +5%) and Mari Petroleum (Mari, +5%) closed at their respective upper limits.”

Moreover, said Bilwani, Hub Power (Hubco, +2.2%) moved up sharply after company notified the exchange during trading hours of its subsidiary receiving letter of support from government for developing a 330 megawatt Mine Mouth Power Project at Thar.

“Pakistan International Airline (PIAA, -9.2%) was amongst the top traded names and closed lower as chairman of this national carrier resigned,” said Bilwani.

JS Global analyst Nabeel Haroon said the market continued its positive momentum as the index gained around 471 points. “E&P sector led the gains in the market as crude oil prices surged to its 17 month high level after OPEC meeting.”

Feto Cement Limited (FECTC, +2.78%) and Dewan Cement Limited (+1.57%) were top performers of the cement sector, as FECTC in its material information disseminated in the market has disclosed that its board of directors has resolved to participate in bidding of Dewan Cement Limited (North Plant), said Haroon.

Trading volumes fell to 383 million shares compared with Friday’s tally of 407 million.

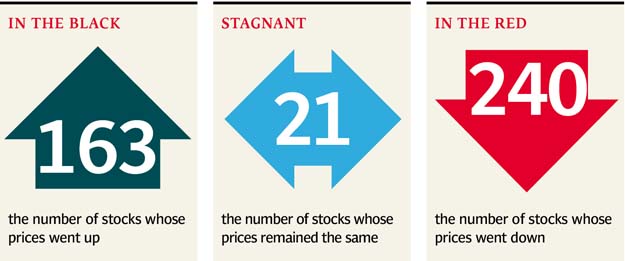

Shares of 424 companies were traded. At the end of the day, 163 stocks closed higher, 240 declined while 21 remained unchanged. The value of shares traded during the day was Rs21.8 billion.

Aisha Steel Mill was the volume leader with 30.5 million shares, gaining Rs0.03 to finish at Rs16.04. It was followed by Pakistan International Bulk Terminal with 28.4 million shares, gaining Rs1.06 to close at Rs34.73 and Bank of Punjab with 21.4 million shares, losing Rs0.85 to close at Rs16.87.

Foreign institutional investors were net sellers of Rs2.3 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 14th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ