Distribution of resources: NFC 2010 and option for the ninth award

It is believed that these significant changes will transform dynamics of the structures of governance

Distribution of resources: NFC 2010 and option for the ninth award

The NFC 2010 was a landmark achievement in the context of radical departure from an orthodox approach of distribution of resources based on the population criterion to a more representative criterion based on multiple indicators.

Pakistan’s participation in the Global Islamic Finance Awards 2016

It is believed that these significant changes will transform dynamics of the structures of governance towards a more rational way and lead to equalisation by strengthening decentralisation and facilitate devolution of the power structure.

The way forward

Although the consensus on the multiple criteria recommended by the NFC Award 2010 is ice breaking and has changed the course of fiscal federalism in Pakistan, nevertheless, the criterion of population has been given extraordinary weightage, which could sacrifice the equalisation objective of federal transfers.

In fact, Pakistan is the only federation where population is assigned an overriding consideration in resource distribution across provinces.

Looking at the international experience, the ninth NFC should practically think to revisit the existing multiple criteria with dominant weight of population, considering that this would require constitutional amendment.

In the context of future agenda for reforming fiscal federalism in Pakistan, some of the significant issues needs attention of social planners and public policymakers.

NFC Award, poverty and social protection

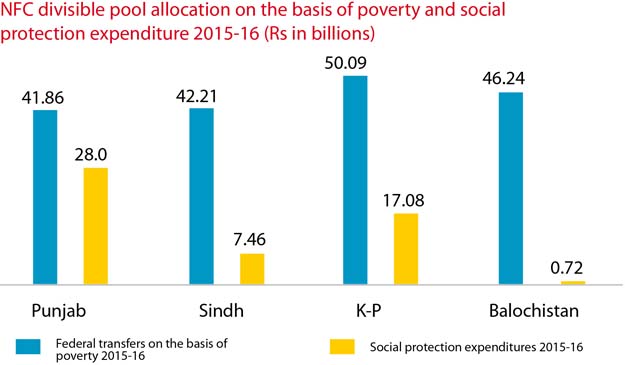

The NFC 2010 allocated 10.3% of the divisible pool of resources to the poverty and backwardness criterion.

The major drawback of this approach is non-representation, as the headcount poverty levels computed through the consumption and expenditure approach come out to be nearly equal in all provinces, therefore, each province is getting almost an equal amount. The implied counter-intuition suggests that both poverty and development across all provinces are same with marginal differences, which is certainly not the case, so should not be overlooked by the ninth NFC.

Reducing disparities

An objective of federal transfers is to help in the creation of horizontal equalisation and in reducing inter-regional disparities. The argument for a more rational regime of fiscal federalism sounds more important if poverty reduction through social protection is a goal.

There are at least two important points to consider. First, poverty statistics based on Multidimensional Poverty Index, a methodology designed by the Oxford Poverty and Human Development Initiative (OPHI), are more robust and representative, therefore, using the OPHI statistics of poverty would generate a more fair distribution across provinces.

Pakistan’s participation in the Global Islamic Finance Awards 2016

Second, the allocation based on poverty has no meaning unless the provinces are bound to use the same for provincial social protection programmes.

For instance, for the year 2015-16, Punjab’s social protection expenditures amounted to 67% of the NFC transfers based on poverty and backwardness, followed by Khyber-Pakhtunkhwa’s 34.1%, Sindh’s 17.7% and Balochistan’s 1.6%.

The commission may propose a constitutional amendment to revise the NFC arrangement taking into account the following considerations.

- The NFC 2010 formula assigned 82% weightage to the population share of provinces. It may be restricted to not more than 50% of the divisible pool.

- Instead of revenue collection and generation, the criteria of provincial tax effort linked with rationalising provincial taxation and fiscal discipline linked with containing debts and deficits may be more useful and would fairly incentivise the tax effort.

- Annual social protection expenditures of a provincial government should not be less than its amount of divisible pool based on poverty and backwardness.

- A certain proportion of royalty of hydroelectric power profits, natural gas and oil may be allocated to enforce social protection programmes for resource producing areas.

A rationalised NFC transfer system would definitely create distributive and allocative efficiency apart from the objective of fiscal equalisation, yet it is a great challenge for a federation like Pakistan which carries over burden of massive centralisation and command devolution from the past.

Reforming NFC’s vertical and horizontal distribution, with sub-national tax reforms, would not only bring a symmetric balance in intergovernmental fiscal relations but would also serve future agenda of inclusive growth and shared prosperity.

The writer is a PhD scholar and research associate at the Centre for Business and Economic Research (CBER), IBA Karachi

Published in The Express Tribune, December 12th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ