Bull run continues as index crosses 45,000 for the 1st time

KSE 100-share Index rises 645.25 points for seventh successive positive finish

Bull Run continues as the index goes higher.

PHOTO: AFP

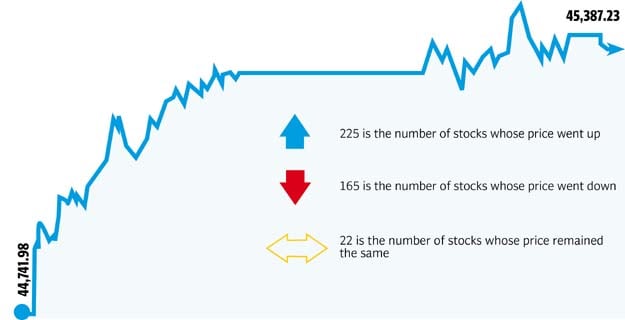

At close, the PSX’s benchmark KSE 100-share Index finished with a rise of 1.44% or 645.25 points to finish at 45,387.23 - its highest finish yet.

market watch: Index settles at record high as bullish run remains

Elixir Securities, in its report, stated that the index was pushed up by gains in Lucky Cement (LUCK PA +5%) as the stock maintained its winning streak for the second straight day after the company unveiled its ambitious investment plans; for capacity expansion in Iraq and diversification into local auto sector through a joint venture with Kia Motors.

“As the day progressed, wider market steadily gained helped by strong local liquidity in index names as participants’ concerns and anxiety were put to bed after court hearing on Panama Papers case was pushed ahead to next year,” said analyst Ali Raza.

“All major sectors including cements, financials, E&Ps and select industrial scrips garnered interest from locals and contributed to day’s gains, while small and mid-caps dominated the volumes table on retail-driven activity,” said Raza.

“We see the current momentum to possibly continue into early next week with benchmark index attempting to gain more ground. Having said that, we see only limited upside ahead given sharp gains in the past six trading sessions and advise against building fresh positions,” the analyst remarked.

According to Global Research, Lucky Cement’s intention to purchase Dewan Cement also alleviated investors’ fear of potential weakening of the cement sector’s pricing power due to inclusion of Chinese cement manufacturers, causing almost all of the cement companies to close in green.

“The oil and gas exploration sector also enjoyed the rally with OGDC (+2.56%), PPL (+2.10%), POL (+3.2%) and MARI (+5.00%) contributing 132 points after international oil continued to remain buoyant over $50/bbl after OPEC’s decision to reduce production,” the report stated.

“ICI (+5.00%) and WYETH (+5.00%) also closed at their upper circuits after ICI announced its intentions to acquire certain assets of WYETH,” the report added.

Meanwhile, JS Global analyst Nabeel Haroon was of the view that cement led the gains in the market as it gained to close +2.4%.

“LUCK in the cement sector gained to close on its upper circuit for the second consecutive day as the company in its material information disseminated in the market yesterday informed that the board of directors of the company in their meeting have authorised an investment of up to Rs12 billion to set up an associated company to assemble and market KIA motor vehicles in Pakistan,” said Haroon.

“OGDC (+2.18%), PPL (+2.13%) and POL (+3.57%) in the E&P sector gained to close in the green zone as crude oil prices have surged to trade above $51/bbl level. This surge in crude oil prices was on the back of production cut meeting between OPEC and 14 other major oil producing nations on Saturday in Vienna,” the analyst remarked.

“Moving forward we recommend investors to stay cautious at current levels,” he added.

Pakistan Stock Exchange: ‘Relatively exceptional’ performance of KSE-100 Index

Trading volumes rose to 407 million shares compared with Thursday’s tally of 368 million.

Shares of 412 companies were traded. At the end of the day, 225 stocks closed higher, 165 declined while 22 remained unchanged. The value of shares traded during the day was Rs22.09 billion.

Aisha Steel Mill was the volume leader with 41.7 million shares, gaining Rs0.54 to finish at Rs16.01. It was followed by Bank of Punjab with 33.2 million shares, gaining Rs0.54 to close at Rs17.72 and Fauji CementXD with 18.9 million shares, gaining Rs0.33 to close at Rs42.10.

Foreign institutional investors were net sellers of Rs990 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 10th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ