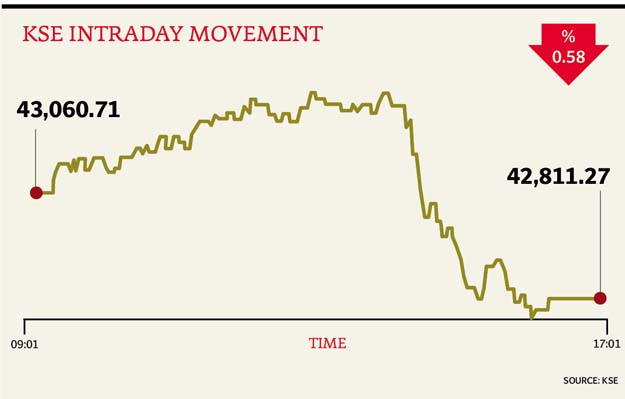

Market watch: Index ends positive streak, falls below 43,000

Benchmark KSE 100-share Index decreases 249.44 points

Activity was mainly led by interest in oil stocks; bourse ends week just shy of 43,000

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a fall of 0.58% or 249.44 points at 42,811.27.

Elixir Securities, in its report, stated stocks were positive in early trade, however, institutional selling primarily in index-heavy banks on profit-taking started the damage (cumulative 155 points dent from MCB -3%, HBL -1.4% and UBL -2.3%).

“Textile sector that struggled throughout the day followed suit and most names (NML, NCL, GADT, GATM; - 5%) hit lower price limits as hopes of a textile incentives package faded amid threats by textile makers of possible protests against alleged discrimination after recent gas prices reduction,” said analyst Faisal Bilwani.

“Hub Power (HUBC PA +1%) covered some of the losses to close higher on value buying, while Engro Corp (ENGRO PA +1.4%) also traded against wider market direction as investors bet on possible guidance from company in the near future on investment/strategy given large cash generation from Engro Food’s EFOODS PA stake sale,” the analyst remarked.

“Volatility helped recovery in volumes that nearly doubled from those seen yesterday with small and mid-caps leading the action.

“We expect volatility to increase as investors track news flow and more importantly the court hearing as Prime Minister’s family faces charges of financial wrong doing. Expect benchmark to trade in a range of 200-300 points and test first technical support level of 42,750,” Bilwani added.

Meanwhile, JS Global analyst Nabeel Haroon said the market opened on a positive note and rallied to make an intraday high of +237 points but came under selling pressure.

“Banking sector remained under pressure as the State Bank of Pakistan (SBP) in its Monetary Policy Statement (MPS) on Saturday kept the interest rate unchanged at 5.75%,” said the analyst.

“On the contrary, investors were anticipating an increase in the policy rate given the rising trend in the inflation (CPI) numbers. MCB (-2.96%) and UBL (-2.33%) were major losers of the aforementioned sector.

“E&P sector continued its downward trajectory on the back of prevailing uncertainty that OPEC members might not reach an agreement on production cut,” said Haroon.

“OPEC members Iran and Iraq have expressed their reservations over production cut, whereas Russia has refused to participate in the talks with OPEC members in their meeting in Vienna.

“POL (-2.09%) and OGDC (-1.27%) were major losers of the aforementioned sector. Moving forward, we reiterate our cautious stance in market and recommend investors to see any dip as an opportunity to buy,” he added.

Trade volumes rose to 585 million shares compared with Monday’s tally of 460 million.

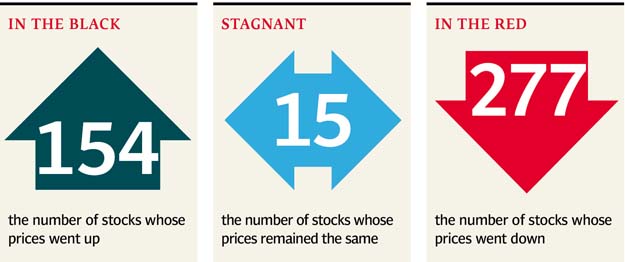

Shares of 426 companies were traded. At the end of the day, 154 stocks closed higher, 277 declined while 15 remained unchanged. The value of shares traded during the day was Rs17.7 billion.

Bank of Punjab was the volume leader with 60.7 million shares, gaining Rs0.97 to finish at Rs19.52. It was followed by Aisha Steel Mills with 41.1 million shares, gaining Rs0.96 to close at Rs14.83 and Sui South Gas with 29.9 million shares, losing Rs2.07 to close at Rs39.57.

Foreign institutional investors were net sellers of Rs1.2 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 30th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ