Weekly review: Stock market rebounds with a rise of 675 points

After losing 524 points in the preceding week, showed fresh gains in index-heavy sectors

Activity was mainly led by interest in oil stocks; bourse ends week just shy of 43,000

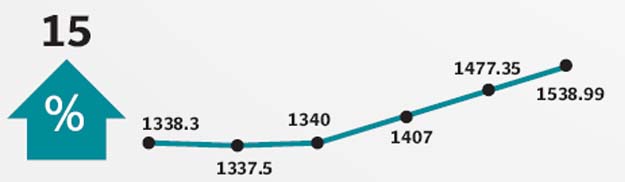

The benchmark KSE 100-share Index, after losing 524 points in the preceding week, showed fresh gains in index-heavy sectors during the week ended November 25, 2016.

Volatility in international crude oil prices fuelled by proposals of production cut to be discussed by the Organisation of Petroleum Exporting Companies (OPEC) in its upcoming meeting sparked interest in oil stocks as investors went on to make fresh bets in the sector.

Moreover, positive sentiments in the cement sector supported the market later in the week.

Top gainers of the week were cement, oil and gas exploration and food and personal care sectors, which went up 4.7%, 3.7% and 3.5% respectively.

Oil and Gas Development Company (+4%), Pakistan Petroleum Limited (+4%) and Pakistan Oilfields Limited (+6.2%) drove gains in the index, cumulatively contributing 57 points while Habib Bank (-1.9%) was the major drag.

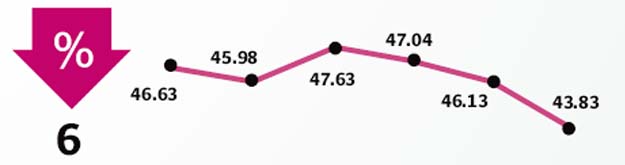

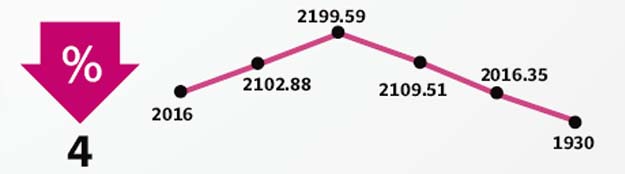

The sectors that failed to make gains included automobile assemblers, banks and technology and communications, which fell 1.1%, 0.9% and 0.6% respectively.

Index movements were also guided by news flow such as a disappointing large-scale manufacturing growth of 2.2% year-on-year in 1QFY17 and 1.9% year-on-year in September 2016, China’s plans to invest another $8.5 billion in rail, energy and infrastructure and the DTH licence auction that fetched Rs14.69 billion.

The banking sector remained subdued despite news that Summit Bank Limited had announced that it would conduct due diligence of Sindh Bank Limited for potential acquisition. Foreigners remained net sellers of $37 million worth of equities mainly due to flight of capital towards developed markets from frontier and emerging economies amidst strengthening of the US dollar.

Locals, particularly mutual funds and banks, on the other hand, continued to absorb most of the selling pressure, with major buying interest tilted towards value stocks, which fell prey to unabated foreign selling.

Overall, the investor participation showed an improvement, reflected in the uptick in average trading volumes, which were up 3.6% week-on-week to 475 million shares per day and the average traded value, up 9.6% week-on-week to $147 million per day. Volume rankings continued to be occupied by second-tier stocks such as Pace Pakistan with 173 million shares, The Bank of Punjab with 145 million shares and PIA with 139 million shares.

Winners of the week

Indus Dyeing

Indus Dyeing & Manufacturing Company Ltd manufactures and sells yarn.

Bestway Cement

Bestway Cement Limited produces and sells cement.

Pakistan Services Limited

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Losers of the week

Sui Southern Gas Company

Sui Southern Gas Company Limited transmits and distributes natural gas, and constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balochistan to Karachi in Sindh.

Philip Morris Pak Limited

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Meezan Bank Limited

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans, and other products through offices located throughout Pakistan.

Published in The Express Tribune, November 27th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ