SBP’s annual report: Sindh ranks worst in collection of income tax on agriculture

In terms of percentage increase in tax, K-P is best performer in 2016

In terms of percentage increase in tax, K-P is best performer in 2016. PHOTO: APP

Except for Sindh, the other three provinces have either improved or maintained their share of tax on income (agriculture) in FY16.

Sindh’s tax on income (agriculture) in FY16 dropped further to just 0.3% from 0.5% in FY15, according to the SBP’s Annual Report on the State of Economy 2015-16.

On the other hand, Khyber-Pakhtunkhwa’s (K-P) share improved from 0.4% to 0.6% while Balochistan improved its share from 0% to 0.1%.

“The situation of tax collection on agriculture income is appalling not only in Sindh, but also in other provinces. This shows lack of commitment on the part of provincial governments,” said Dr Kaiser Bengali, a left-leaning economist.

An increase of 0.1% or a similar change in agriculture tax income would not bring any significant change on the ground. “The fact is that no province is collecting this tax seriously,” he added.

“This dismal situation can certainly be changed provided we have the political will,” he said.

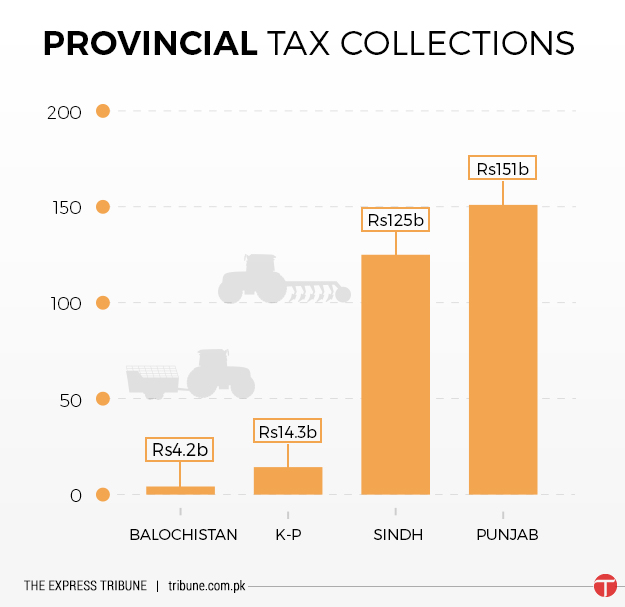

The Sindh government collected Rs125 billion (0.3% of this makes up just Rs375 million) in total provincial taxes in FY16, up 14% from Rs110 billion in FY15.

What is disappointing is that the Sindh government’s agriculture income tax has never exceeded 1% of the total tax collection since FY10 when it was 0.9% – the highest percentage in the last seven years.

Punjab’s collection

The total tax collection of Punjab, which contributes over 50% to Pakistan’s GDP, was Rs151 billion in FY16, up 54% compared to Rs98 billion in FY15. However, 1% of Rs151 billion makes up just Rs1.5 billion, which is miniscule considering the size of agriculture in this breadbasket of the country.

Punjab’s case is quite different because this province’s agriculture income tax collection in FY10 was 2.7% – the highest percentage of agriculture tax collection among provinces in the last seven years. Since then, it has never reached this level, in fact, it has never collected more than 1.1% in any of the last seven years.

Khyber-Pakhtunkhwa

Although as a percentage of total tax, the agriculture income tax collection in K-P improved in FY16, but the overall picture in the province is as bleak as in others.

For instance, the northwestern province collected just Rs14.3 billion in FY16, down 29% from Rs20 billion in FY15. Out of the Rs14.3 billion, the share of agriculture income tax was just 0.6% or Rs85 million.

Similar to Sindh, the province is struggling to collect even 1% of the total provincial tax collection in agriculture income tax.

Balochistan

Perhaps the story of Balochistan is even worse. The country’s largest province in terms of landmass collected just 0.1% in agriculture income tax, though it was the highest in the last five years.

The total tax collection of the province was miserably low at just Rs4.2 billion (0.1% of Rs4.2 billion makes up just Rs4.2 million).

The writer is a staff correspondent

Published in The Express Tribune, November 21st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ