market watch: Stocks fall amid selling pressure

Benchmark KSE 100-share Index loses 323.19 points

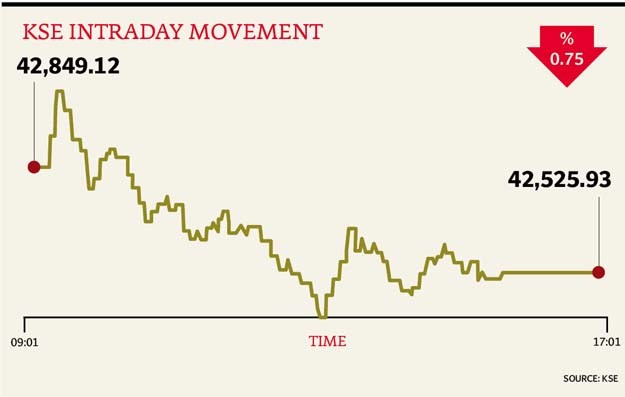

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share index recorded a loss of 0.75% or 323.19 points to end at 42,525.93.

Elixir Securities analyst Faisal Bilwani said the equities closed lower with the start of new week and the benchmark index settled near 42,500.

“Bourse’s activity was primarily driven by profit-booking in index names as investors were spooked by losses in regional markets,” he said.

“Stocks opened positive with the index testing new intraday high above 43,000, but the market could not sustain the rise for long and faced a steady decline mainly on anxiety over geo-politics as tensions once again flared on the Pakistan-India border.”

The index-heavy exploration and production sector and financial stocks led the early decline with the former tracking global crude, while cement shares that were higher in early trade also became a victim of profit-taking and closed in the red, he said.

Index-heavy United Bank (-2.6%) and Habib Bank (-1.7%) cumulatively dented the KSE-100 index by over 100 points, while Lucky Cement (-2.1%) and Pakistan Petroleum (-2.4%) pulled the index down by over 25 points each.

JS Global analyst Nabeel Haroon said the market opened on a positive note and rallied to hit an intraday high of +235 points but came under selling pressure during later hours.

Haroon said Indus Motor (-1.99%) in the automobile sector lost value, as data indicated a year-on-year decline of 26% in the automobile assembler sales for October.

“Both gas utilities - Sui Northern Gas Pipelines (-0.90%) and Sui Southern Gas Company (-1.11%) - declined to close in the red zone on the back of news that the government has decided not to increase gas prices.”

Fauji Fertilizer Bin Qasim (1.31%) gained as fertiliser importers turned down the government’s proposal to cut prices of di-ammonium phosphate from Rs2,500 to Rs2,250 per 50kg bag to bring them in line with the recent decline in international market prices.

Trade volumes rose to 554 million shares compared with Friday’s tally of 542 million.

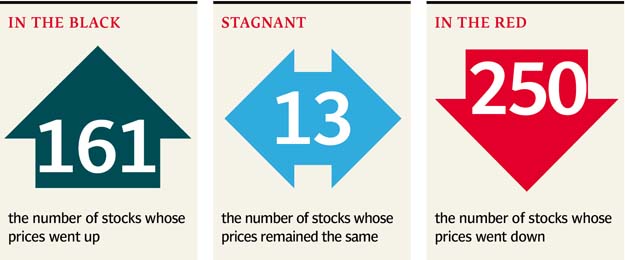

Shares of 424 companies were traded. At the end of the day, 161 stocks closed higher, 250 declined while 13 remained unchanged. The value of shares traded during the day was Rs17.6 billion.

The Bank of Punjab was the volume leader with 62.6 million shares, gaining Rs0.22 to finish at Rs19.81. It was followed by PIAC (A) with 47.1 million shares, gaining Rs0.20 to close at Rs11.64 and Summit Bank with 42.7 million shares, gaining Rs0.45 to close at Rs4.2.

Foreign institutional investors were net sellers of Rs710 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 15th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ