Market watch: Foreigners buy, but index still ends lower

Benchmark KSE 100-share Index falls 114.43 points

Benchmark KSE 100-share Index falls 114.43 points.

Stocks opened lower and the KSE-100 Index dipped close to the 39,500-point mark when value hunters grabbed the opportunity and helped trim the losses.

By close on Friday, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a decline of 0.29% or 114.43 points to end at 39,872.88

Elixir Securities analyst Ali Raza said equities closed lower in a choppy trading session as domestic politics continued to test nerves.

“Market opened gap down in early trade with benchmark KSE-100 index sliding by nearly 450 points owing to political atmosphere that turned tense late evening (Thursday) after a crackdown by government against PTI workers and blockage of routes leading to planned protest areas,” said Raza.

“Market, however, bounced back near first session’s end with KSE-100 index briefly entering the green zone on institution led value-buying. Volatility remained higher in the second session as political noise kept investors on high alert.

“However, benchmark index managed to close the day with trimmed losses as bargain hunters provided support while higher earnings announcements by select companies namely Nishat Chunian (NCL +5%) and Fauji Cement (FCCL PA +2.9%) also triggered selective buying. Moreover, both gas companies Sui Northern Gas (SNGP +5%) and Sui Southern Gas (SSGC +5%) came under spotlight as rumours surfaced of a revised return formula under consideration by Ogra that will have a favourable recurring impact on their earnings.

“We see volatile trading to continue while political developments over the weekend will play a vital role next week in setting the tone.”

JS Global analyst Ahmed Saeed Khan said volatility prevailed on the last day of the roll over week as the index juggled between -449 and +74 points. “The ever rising political noise kept investors confidence low as lockdown of capital, along with brutal confrontation between law enforcement and political protestors, kept the mood sorrow throughout the trading.

“The energy sector remained mostly in the red zone throughout the day on the back of depressed global crude oil prices as OPEC committee meets in Vienna to discuss output quotas for members participating in agreement to cut production.

“Overall, we expect that market would remain range bound in the upcoming week, where negative pressure on the market can be expected. The situation between law enforcement and protestors is continuously deteriorating with each passing moment, therefore caution ahead is advised.”

Trade volumes fell to 329 million shares compared with Thursday’s tally of 384 million.

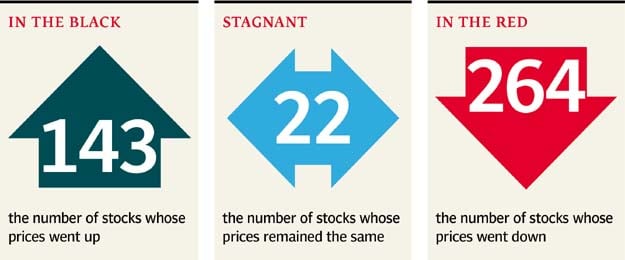

Shares of 429 companies were traded. At the end of the day, 143 stocks closed higher, 264 declined while 22 remained unchanged. The value of shares traded during the day was Rs10.8 billion.

Bank of Punjab was the volume leader with 47.8 million shares, losing Rs0.59 to finish at Rs15.74. It was followed by TRG Pakistan with 18 million shares, losing Rs1.37 to close at Rs39.53 and K-Electric with 14.6 million shares, gaining Rs0.11 to close at Rs9.10.

Foreign institutional investors were net buyers of Rs496 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 29th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ