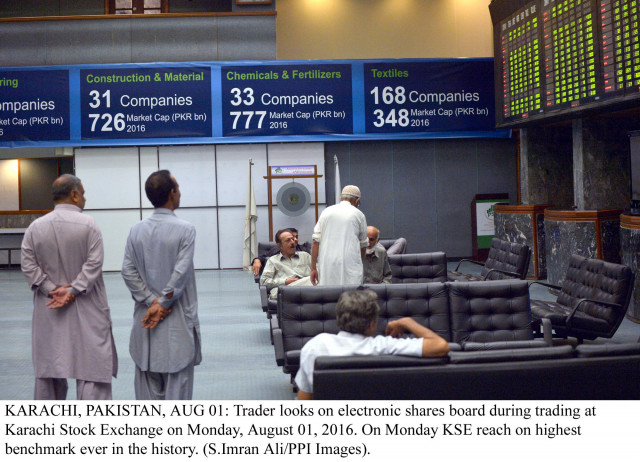

market watch: Bourse, led by cement stocks, closes at new all-time high

Benchmark KSE 100-share Index rises 444.50 points

Benchmark KSE 100-share Index rises 444.50 points.

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a rise of 1.10% or 444.50 points to end at 40,986.31.

Elixir Securities, in its report, said activity in index names considerably improved as $119 million worth of shares exchanged hands on the benchmark index, up 25% versus last week’s average.

“Cement sector primarily came under the spotlight as investors cheered weekend news of Ecnec approving proposals of dam construction and power projects; Lucky Cement (+5%) settled again over Rs700 per share and contributed the most to the day’s gains, while Maple Leaf Cement (+3.97%) and Dera Ghazi Khan Cement (+2.41%) also contributed to the rally.”

Moreover, slightly lower-than-estimated inflation reading for September at 3.88% YoY was largely ignored by the market that primarily tracked institutional flows while small and mid-caps led volumes with over 565 million shares exchanging hands on the KSE All Shares Index, said the report.

“We see volatile market testing new highs in the days ahead with resistance likely not before 41,500 points as investors ignore noise from domestic as well as geo-politics,” remarked Elixir Securities analyst Faisal Bilwani.

Meanwhile, JS Global analyst Ahmed Saeed Khan said positivity prevailed as the index surged around 444 points to close at an all-time high of 40,986. “News of Shanghai Stock Exchange’s approach to buy a stake in PSX kept the investor mood upbeat throughout the day,” he said.

“CPI for the month of September clocked in at 3.88% vs 3.79% for July; the trend of rising inflation strengthens the case for interest rate hike in the upcoming monetary policies.”

On the back of that reason, a rally in the banking sector was witnessed. Top index movers of the heaviest sector were UBL (+2.45%) and MCB Bank (+1.81%).

A rally in the cement sector was witnessed in anticipation of strong dispatch numbers for September and top index movers of the sector were Lucky Cement and Maple Leaf Cement, he said.

“Overall the market sentiment remains strong and we expect further upside from these levels,” said Khan.

Trade volumes rose to 568 million shares compared with Friday’s tally of 436 million.

Shares of 463 companies were traded. At the end of the day, 334 stocks closed higher, 117 declined while 12 remained unchanged. The value of shares traded during the day was Rs17.5 billion.

Pakistan International Airlines was the volume leader with 43.8 million shares, gaining Rs0.65 to finish at Rs8.83. It was followed by The Bank of Punjab with 43.4 million shares, gaining Rs0.78 to close at Rs14.10 and Pace Pakistan Limited with 42.7 million shares, losing Rs0.90 to close at Rs11.48.

Foreign institutional investors were net buyers of Rs417 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 4th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ