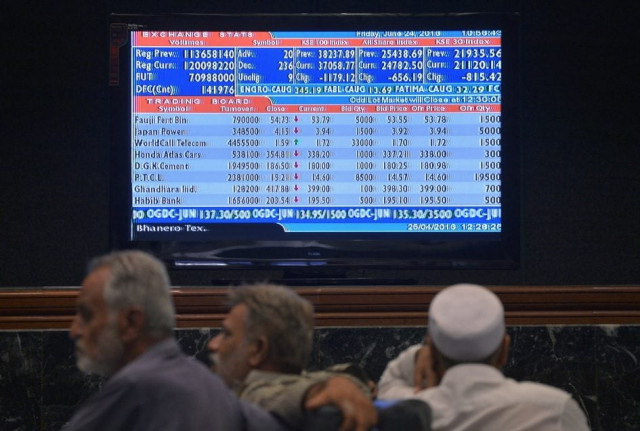

Market watch: Stocks rebound; banking, oil sectors shine

Benchmark KSE-100 index rises 363.89 points

PHOTO: EXPRESS

Safety assurances by the military and hope of an agreement regarding oil supply gave investors something to look forward to as the benchmark-100 index rose 0.91% Thursday.

At close on Thursday, the Pakistan Stock Exchange’s benchmark KSE-100 index finished 363.89 points higher to end at 40,135.31.

Elixir Securities analyst Ali Raza said equities rebounded with benchmark KSE-100 index covering most of the losses with across the board buying.

“Market opened higher from the word go as gains in the region coupled with Wednesday’s positive assessment over cross-border tension by country’s top military leadership, who ruled out possibility of any imminent danger from neighbour country, eased investors’ concerns.

“Sideboard plays once again led the action albeit on increased volatility, while select index names in oils, cements and financials attracted fresh interest from value buyers with Habib Bank (HBL +1.97%), Oil and Gas Development Company (OGDC +1.65%) and Lucky Cements (+1.57%) leading day’s gains.

“Meanwhile, K-Electric (KEL) gained 3.64% and fetched most volumes in over three weeks as investors cheered news of Shanghai Electric Power emerging as a lead bidder in deal to buy 66.40% stake in K-Electric.

“We expect volatile trading with market experiencing relatively dull volumes as investors brace for monetary policy statement over the weekend where Elixir expects no change to benchmark policy rate.”

Meanwhile, JS Global analyst Nabeel Haroon said positivity prevailed with banking sector leading the gains.

“The sector closed (+1.47%) higher from its previous day close. HBL (+1.97%) and MCB (+0.48%) were top performers of the aforementioned sector.

“Automobile sector gained on the back of decline in yen prices. Honda Atlas Cars (+2.04%) and Pak Suzuki Motor (+2.01%) were major gainers of the aforementioned sector.

“OGDC (+1.68%), POL (+1.02%) and PPL (+0.31%) in the exploration and production sector gained on the back of surge in crude oil prices, as Saudi Arabia and Iran along with another OPEC member Qatar met at OPEC’s headquarter in Vienna to prepare for informal talks between OPEC members and Russia next week.

“Al Shaheer (ASC +1.14%) gained as the company posted growth in its earnings for its FY16 result. In its result, the company posted earnings per share of Rs2.95 versus Rs2.19 per share last year. This earning was accompanied by 15% stock bonus.”

Trade volumes fell to 660 million shares compared with Wednesday’s tally of 693 million shares.

Shares of 441 companies were traded on Thursday. At the end of the day, 353 stocks closed higher, 78 declined while 10 remained unchanged. The value of shares traded during the day was Rs17 billion.

Pace (Pakistan) Limited was the volume leader with 54.2 million shares, gaining Rs0.96 to finish at Rs10.97. It was followed by WorldCall Telecom with 50.2 million shares, gaining Rs0.44 to close at Rs2.79 and K-Electric with 50.1 million shares, gaining Rs0.32 to close at Rs9.12.

Foreign institutional investors were net buyers of Rs147 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 23rd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ