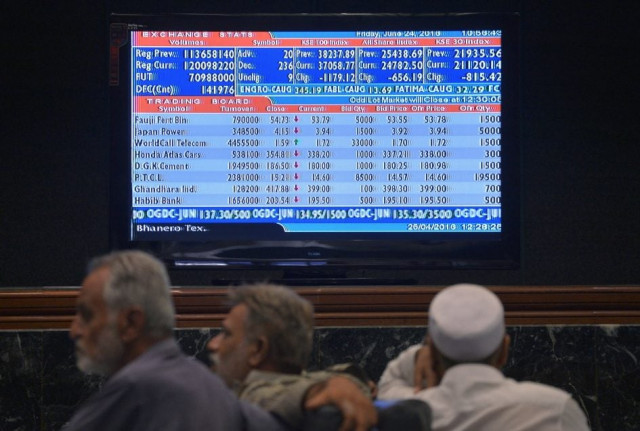

Market watch: Volumes through the roof as volatile trading continues

Benchmark KSE 100-share Index loses 74.26 points

PHOTO: EXPRESS

At close, the Pakistan Stock Exchange’s benchmark KSE-100 index ended 0.18% or 74.26 points lower to end at 40,340.46.

Elixir Securities analyst Faisal Bilwani said equities tested nerves while trading volatile and closed marginally negative as mid-day recovery helped cover morning declines that had pulled benchmark KSE-100 index lower owing to early profit-taking - primarily in sideboard plays.

“Within ten minutes after a positive open, KSE-100 index tumbled to test support near 40,150 levels as investors grabbed opportunity to lock in their stellar profits in recent out performers in third tier and penny plays.

“Index names yet again saw limited institutional interest with Engro Corp (+1.9%) attracting fresh flows near close of day while most volumes went through in penny and speculative stocks on retail investors activity, evident from steep volumes traded on bourse.

“Expect volatility to increase as retail investors drive most action on the bourse while flows, primarily from foreign institutions, will guide direction in index names.”

Meanwhile, JS Global analyst Nabeel Haroon said volatility prevailed as the index traded between an intraday high of +94 points and intraday low of -285 points.

“Despite volatility, there was a surge in a number of shares traded. Honda Atlas Cars (HCAR) continued to garner investors’ interest, as it gained to close on its upper circuit on the back of 50% month-on-month increase in sales number for the month of August.

“Oil and Gas Development Company (OGDC -0.07%) and Pakistan Petroleum (PPL -0.35%) in the exploration and production sector lost value to close in the red zone, as crude oil prices declined on the back of speculation of supply glut to persist ahead of US oil inventory numbers due to be announced.

“Berger Paints (BERG +4.3%) gained as the company declared its result for FY16. In its results, company posted earnings per share of Rs10.13 along with a final cash dividend of Rs.4.5 per share. We reiterate our bullish stance on the market and recommend investor accumulate on dips.”

Trade volumes rose to 903 million shares compared with Monday’s tally of 877 million.

Shares of 442 companies were traded. At the end of the day, 175 stocks closed higher, 250 declined while 17 remained unchanged. The value of shares traded during the day was Rs20.7 billion.

Dewan Salman was the volume leader with 70.7 million shares, losing Rs0.58 to finish at Rs8.19. It was followed by Pace (Pak) with 59.8 million shares, gaining Rs0.34 to close at Rs10.12 and Bank of Punjab with 50.3 million shares, losing Rs0.48 to close at Rs12.14.

Foreign institutional investors were net sellers of Rs518 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 21st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ