Weekly review: KSE-100 index ends shorter week nearly flat

Speculators focused on small-caps as crude stocks plunged

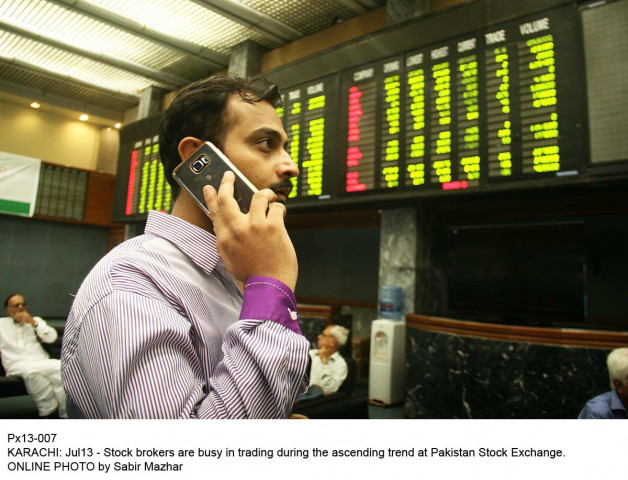

Increased focus on penny stocks, however, can also be seen as an indication of an over-heated bourse with liquidity overflowing into speculative options. PHOTO: ONLINE

Eid holidays cut the week short as the exchange was only active for Thursday and Friday.

On Thursday, traders tracked the near ten per cent drop in international crude oil prices, further fuelling the bearish trend. Many of the index heavy names soon followed suit, channeling much of the investor interest towards small cap names.

Friday followed a similar pattern, with investor interest fixated on small caps - WorldCall Telecom took the lead amongst low tier names as turnover in it alone would have constituted the entire turnover in the bourse on a rather listless day.

Furthermore, chemicals looked promising to investors on Friday on the back of depressed crude oil prices.

Optimism, largely fuelled by penny stocks picking inordinate value, meant that bullish streak once again took hold on the last trading day of the week and managed to push the benchmark back to - and a little over - the previous week’s closing.

According to Elixir Securities analyst Faisal Bilwani, a volatile market is expected next week with index names tracking institutional activity while speculative and penny plays will continue to lead volumes. “We advise caution in jumping on bandwagon in third tier stocks and recommend staying long in fundamentally strong liquid names at current levels.”

However Global Research did not share similar reservations. “We believe strong investor confidence, as evidenced by the market reaching new highs with record volumes, will allow the index to carry forward its momentum during next week’s trading session.”

Increased focus on penny stocks, however, can also be seen as an indication of an over-heated bourse with liquidity overflowing into speculative options. On the macro front, a 1.17% decrease was observed in foreign exchange reserves held by State Bank of Pakistan week-on-week as of September 9. Foreign institutional portfolio investment (FIPI) recorded an outflow of $5.27 million during the week as opposed to outflow of $7.06 million last week.

Published in The Express Tribune, September 18th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ