KSE-100 breaks new ground despite net foreign selling

Positive fundamentals meant bulls continued to dominate

EFU Life Assurance Limited provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan. PHOTO: ONLINE

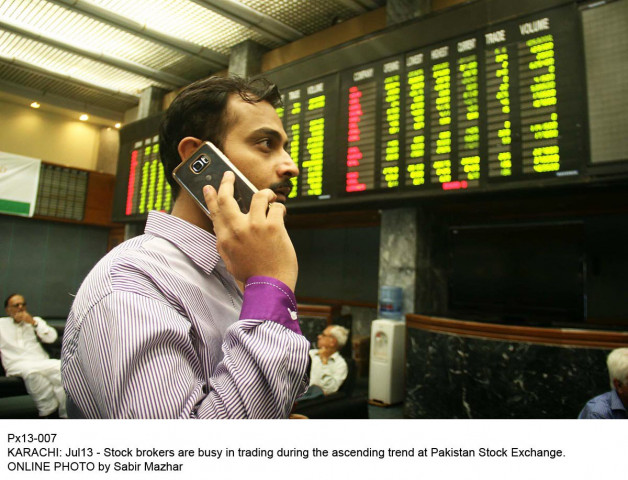

The market saw unprecedented enthusiasm, especially among domestic traders as bulls continued to dominate despite foreign investors remaining net sellers of $7 million. Small and mid-caps dominated volumes with retail investors continuing to ride the bullish tide.

The week started off with WTI crude for October trading near $43 per barrel. However, it rose to $47 per barrel by the end as the oil and gas sector recovered. Data showed 21% year-on-year increase for August in oil demand further helping the momentum.

China-Pakistan Economic Corridor’s (CPEC) biggest beneficiary sector - cements - saw positive response as latest data for August showed over 20% year-on-year increase in domestic demand.

The detrimental effect on real estate due to changes in income tax ordinance has yet to be reflected in cement data.

Furthermore, positivity for different quarters prompted the bullish streak. Prime Minister’s much awaited visit to Pakistan Stock Exchange was one of them, where he distributed awards to the top 25 performing companies.

Furthermore, remittance data showed a substantial 15% year-on-year jump according to the latest August data.

However, a 0.35% decrease was observed in foreign exchange reserves held by State Bank of Pakistan week-on-week as of September 2. Additionally, a substantial drop in exports further aggravated the balance of trade deficit.

Foreign institutional portfolio investment (FIPI) recorded an outflow of $7.06 million during the week as opposed to outflow of $3.34 million last week.

Average volumes traded rose 23% week-on-week with the number of shares traded propping up to 457 million per day.

Winners of the week

Associated Services Limited

Earlier called Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

TRG Pakistan

TRG Pakistan operates as an information technology company. It provides business support and software services to different companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

The Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services.

Losers of the week

Murree Brewery XDXB

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

EFU Life Assurance XD

EFU Life Assurance Limited provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan.

Pakistan Tobacco Company XD

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Published in The Express Tribune, September 11th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ