Positivity prevails as index reaches all-time high

Bull run led by financial, cement and oil stocks

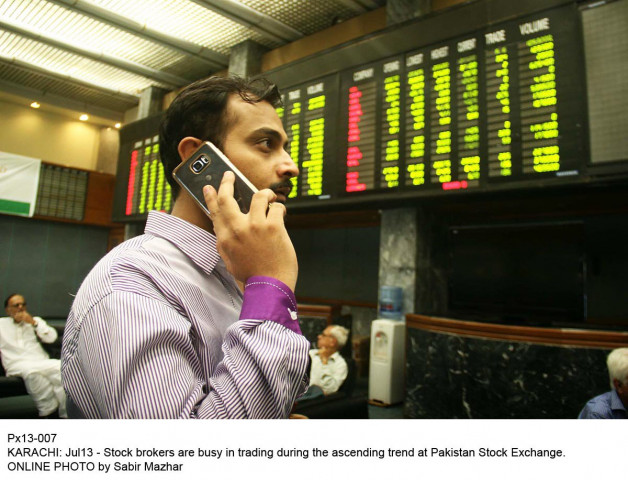

Average daily volumes witnessed a 18% increase, clocking in at 265.1 million shares. On the other hand, average daily values climbed 5%, to Rs11.4 billion/$109.3 million. PHOTO: ONLINE

Nonetheless, the KSE-100 Index registered a 1.2% increase week-on-week to finish at 39,908 points.

The week-long rally, which saw the index finish positive on all five trading days of the week, was mostly led by index heavy sectors such as oil and gas exploration, financials and cement.

Pakistan Stock Exchange: MSCI upgrade revives foreign investor interest

Oils gained on the back of international prices going up and local giants such as Pakistan Petroleum Limited (+4.9%) and Oil and Gas Development Limited (+3.0%) contributing 70 points and 49 points, respectively. The sector overall was up 3.7%.

Banks contributed mainly on the back of institutional buying as reactions on corporate results. UBL (+8.1%) emerged as a key performer during the week, contributing 144 points to the index with continued exuberance post its 1H2016 financial results that outperformed market consensus. HBL also (+3.3%) tagged along with overall gains in the sector (+2.5%).

Cement sector gained 2.3% week-on-week as it reacted positively to better than expected off-take numbers.

Increased activity was also witnessed in auto sector on the back of monthly car sales data and yen’s movement.

One of the most active stocks of the week was K-Electric (KEL) as it dominated the volume charts. KEL was a major contributor towards the traded volume especially on Thursday as rumour of its acquisition by Shanghai Electric and Engro Corporation were making rounds. However, the rumours were dismissed soon enough by both KEL and Engro. As a result, its share price fell on Friday but volumes still remained high.

Market watch: Index breaks past 40,000 level, but gains trimmed in last hour

Average daily volumes witnessed a 18% increase, clocking in at 265.1 million shares. On the other hand, average daily values climbed 5%, to Rs11.4 billion/$109.3 million.

Foreigners remained net sellers during the week, offloading $1.0 million worth of shares during the outgoing week.

Winners of the week

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group offers a number of lines of coverage, including fire, marine, aviation, transport, motor and miscellaneous.

Bannu Woollen

Bannu Woollen Mills Limited manufactures and sells woollen yarn, cloth and blankets.

United Bank Limited

United Bank Ltd provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Losers of the week

Feroze1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Kohinoor Textile

Kohinoor Textile Mills Ltd produces textiles. The company weaves, dyes and prints natural and synthetic fibres.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Published in The Express Tribune, August 14th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ