Budget 2016-17: PBA disappointed with FBR for ignoring proposals

Association expressed concern over extension of 4% super tax on banks’ income

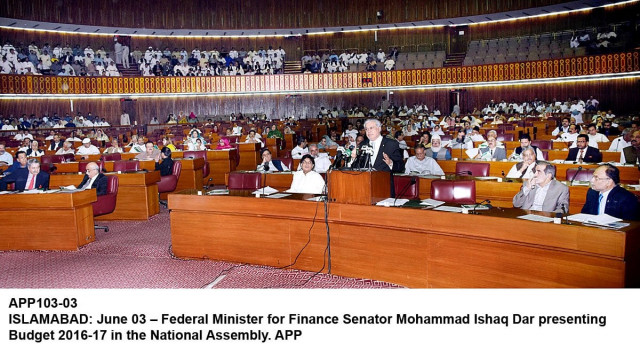

Finance Minister Ishaq Dar present the 2016-17 budget in the National Assembly. PHOTO: APP/FILE

In a statement on Monday, the PBA reminded the federal tax collection authority that its proposals have been ignored despite the fact that its members cumulatively pay the highest amount of taxes to the national exchequer.

Banks paid total taxes of Rs121 billion for the 12-month period ending on December 31, 2015. In addition, banks also collected and paid to the FBR withholding tax of Rs105 billion for Jan-Dec.

The PBA expressed its concern about the re-imposition of the one-time super tax on the banks’ tax income at 4%. By disallowing depreciation and business losses that are brought forward, the banks’ effective tax rate will further go up, the PBA said.

Praising the government’s decision to reduce the income tax rate for business income of the corporate sector from 32% in 2015-16 to 31% in 2016-17, the PBA noted that the income tax rate for banks has still not been rationalised.

Banks will have to pay the income tax at the higher rate of 35% in the next fiscal year while non-banking companies will be charged at 31%.

“This anomaly needs to be immediately corrected,” the PBA said, adding the advance tax instalment payment interval has also been retained on a monthly basis for banks although it is quarterly for other sectors.

With respect to the advance tax on banking transactions other than through cash, the PBA said vulnerable groups, including widows, pensioners, retirees and students will be receiving very low compensation that will fall below the taxable threshold.

“As such, they should not be liable to pay the tax. But under the federal budget, the withholding tax is being deducted on their savings whenever they make withdrawals, which is unfair, as they cannot claim credit for the deducted amount,” it added.

The PBA said this tax is likely to adversely affect the National Financial Inclusion Strategy and lead to financial exclusion in Pakistan.

The PBA had recommended that the relevant section be removed from the bill and, if that is not possible, an exemption be provided to the vulnerable groups. It also recommended that the threshold for the transfer transactions be increased to Rs100,000.

The withholding tax on cash withdrawals from each account of Rs50,000 and above per day has been extended to cover cash withdrawals of the same amount from all bank accounts.

“Not only is this unreasonable for bank customers, but also is practically impossible for each bank to instantly compare with all other banks whether withdrawals of over Rs50,000 have taken place every day,” it said.

Most analysts agree that the proposed federal budget would adversely affect the banking sector. The continuation of tax measures introduced in the budget in the preceding year will keep hurting banks’ earnings by approximately 6% in 2016, they say.

“(Tax measures) will have an earnings impact of around 6% in 2016, as banks will likely book additional tax burden in the April-June quarter,” according to Topline Securities Senior Research Analyst Umair Naseer.

Published in The Express Tribune, June 21st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ