Weekly review: Subdued week at bourse ahead of budget announcement

KSE 100-share Index closed flat with banking stocks taking a beating

KSE 100-share Index closed flat with banking stocks taking a beating.

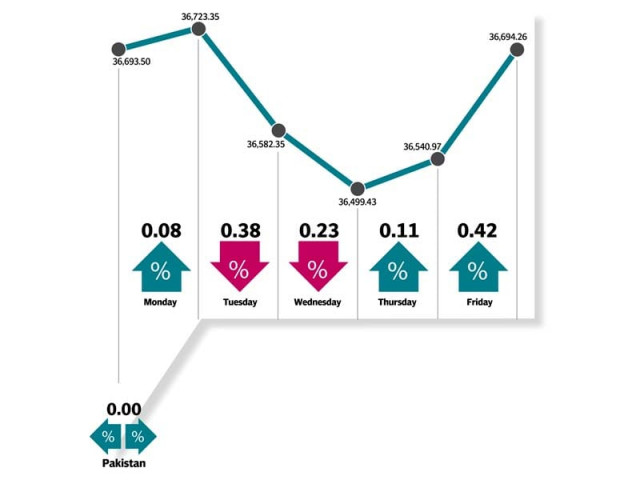

The benchmark KSE 100-share Index closed the week at 36,694 points.

Earlier, the market started the week on a mixed note - a trend that continued until its close on Friday. It opened on a subdued note due to financial stocks that received a battering after the State Bank of Pakistan announced a 25-basis-point cut in the policy rate over the weekend.

However, towards the end of the week, the market regained the lost momentum as investor interest emerged in select stocks.

One of the key highlights of the week was a significant rise in crude oil prices in the international markets. Both West Texas Intermediate (WTI) and Brent crude hit fresh six-month highs, however, the price recovery failed to spark excitement in the oil sector that ended 0.2% lower week-on-week.

With the 2016-17 budget announcement due on June 3, the stock market remained mostly dominated by news flow regarding government’s tax and incentive plans as well as growth and investment targets for the next fiscal year. However, uncertainty prevailed due to mixed reports about the new budget.

The government has finalised a growth target of 5.7% for the next year compared to reported economic expansion of 4.7% in FY16 and put the fiscal deficit target at 3.8% of total national income.

News reports also suggested that the government was considering granting a relief package to the agriculture and export sectors.

Meanwhile, at a press briefing at a pre-budget seminar, prominent industrialist Arif Habib suggested that the tax on the issue of bonus shares by companies be removed because it had no significant impact.

“It is only an accounting entry and has discouraged companies from issuing bonus shares since its introduction,” he said.

Habib also proposed rationalising the capital gains tax by reducing its rate to 10% from 15% in the case of a security where the holding period was less than six months.

During the week under review, food producers (+3.8% week-on-week) were the star performers on the stock market. K-Electric also recorded above-average volumes on talk of possible sale of its majority stake by the Abraaj Group. K-Electric volumes were up 32% to 42 million shares.

Hascol Petroleum also registered a significant increase in its share price on the back of revelation that the company would establish an oil storage terminal at Port Qasim.

During the week, foreigners were net sellers of $3.8 million. The average traded volume dropped 23% to 249 million shares while average daily value fell 11% to $96 million.

Winners of the week

Feroze 1888

Feroze 1888 Mills Limited manufactures and sells a wide range of cotton towels and fabrics.

Pakistan Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Hascol Petroleum Limited

Hascol Petroleum Limited is engaged in the purchase, storage and sale of petroleum products such as fuel oil, high speed diesel, gasoline, Jet A-1, LPG and lubricants.

Losers of the week

Bannu Woollen

Bannu Woollen Mills Limited manufactures and sells woollen yarn, cloth and blankets.

MCB Bank Limited

MCB Bank Ltd is a full service commercial bank. The bank offers a wide range of financial products and advice to personal and corporate customers, including online banking services.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

Published in The Express Tribune, May 29th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ