Weekly review: Bourse enters new territory as political tension eases

Possible upgrade of Pakistan’s market in MSCI, news of $300m ADB loan contributed to index gains

Possible upgrade of Pakistan’s market in MSCI, news of $300m ADB loan contributed to index gains.

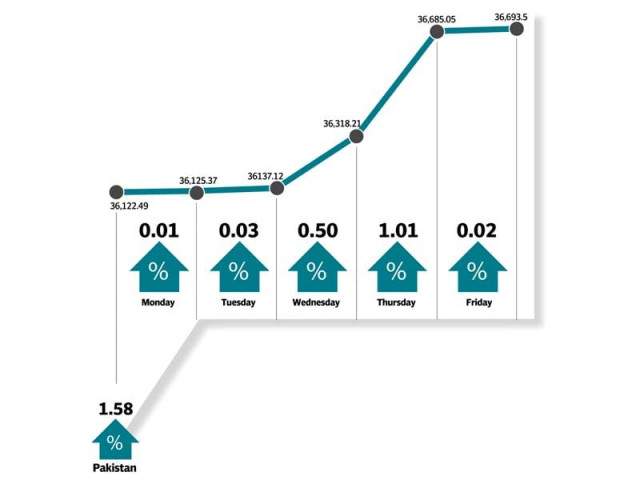

During the week, the market also closed at the highest-ever level of 36,694 points.

One of the main reasons behind the positive sentiments was the possible upgrade of Pakistan’s bourse in the MSCI from the frontier to emerging market in June 2016. Additionally, upward movement of international oil prices also helped the market pick up momentum.

The political uncertainty regarding the government’s fate after Panama leaks subsided and the lower political pressure also helped the index reach new highs.

Gains in the index were primarily led by mid-tier stocks as Fauji Meat (+19.8%) and Pakistan International Bulk Terminal (+12.7%) cumulatively contributed 177.3 points, whereas blue-chip stocks (MCB Bank, Pakistan Petroleum and Kapco) added 241 points to the index.

On the other hand, the banking sector mostly contributed to the decline with Habib Bank, National Bank, United Bank and Bank AL Habib cumulatively erasing 49 points from the index.

Foreign institutional portfolio investment recorded an outflow of $6.98 million versus outflow of $12.71 million last week.

On the macro side, the latest data of the State Bank of Pakistan (SBP) revealed that foreign direct investment crossed $1 billion during 10MFY16, an increase of 5% year-on-year. China was the biggest contributor followed by Hong Kong and Italy.

On the other hand, total liquid foreign exchange reserves rose to an all-time high of $21.32 billion as State Bank holdings increased to $16.52 billion due to export and remittance receipts.

Additionally, news that the Asian Development Bank (ADB) was expected to approve the first loan tranche of $300 million out of $600 million for the restructuring of public sector enterprises (PSEs) during the next two years also helped the index.

This week, the telecom sector came into the limelight, as news emerged that the sector was likely to get major incentives in the upcoming budget for 2016-17, including extension in the tax holiday for telecom exports for three years and tax reduction for IT services companies from 8% to 2%.

Activity during the week improved as average daily volumes surged to 325 million shares, up 10.5% week-on-week, while average daily values rose 1.4% week-on-week to Rs11.4 million. Foreigners, though, remained net sellers of $7 million during the week.

Winners of the week

Feroze 1888 Mills Limited

Feroze 1888 Mills Limited manufactures and sells a wide range of cotton towels and fabrics.

Ferozesons Laboratories

Ferozesons Laboratories Limited manufactures and sells pharmaceutical products.

Pakistan International Bulk Terminal

Pakistan International Bulk Terminal Limited is being set up as the country’s first terminal for handling coal, clinker and cement on build, operate and transfer (BOT) basis at Port Qasim.

Losers of the week

Pakistan International Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Punjab Oil Mills

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil and laundry soap.

Published in The Express Tribune, May 22nd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ