FBR moves to seek info on 200 Pakistanis’ assets

The decision to seek information from the journalist is subject to the approval of Finance and Revenue Minister

The decision to seek information from the journalist is subject to the approval of Finance and Revenue Minister.

Succumbing to intense public pressure, the Federal Board of Revenue (FBR) decided on Wednesday to write a letter, asking a local reporter to share information about assets of 200 Pakistanis named in Panama Papers.

Umer Cheema is a member of the International Consortium of Investigative Journalists (ICIJ), which divulged information on funds kept by politicians and celebrities from around the world.

Panama Papers: Sharifs should come clean on assets: Aleem

But the chances of the tax authority achieving success are limited by a host of legal lacunas.

The information contained in Panama Papers created sharp political oscillations in many countries, including Pakistan.

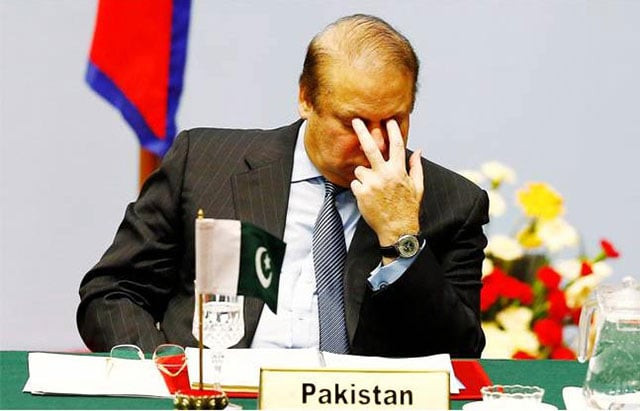

The family of Prime Minister Nawaz Sharif along with 200 other politicians, businessmen and judges named in the trove of documents allegedly own foreign assets maintained by offshore companies.

The exposed data is now popularly known as ‘Panama Leaks’.

The decision to seek information from the journalist is subject to the approval of Finance and Revenue Minister Ishaq Dar, said an official after the meeting held on the issue at FBR headquarters.

He said the FBR would only move against these individuals if it obtained “actionable information”, which could be defended in courts.

However, the FBR insists that it “cannot move against these individuals until it has actionable information”.

PTI seeks to bring offshore assets in law's ambit

FBR contends that Pakistan does not have avoidance of double taxation treaties and exchange of information treaties with Panama or the British Virgin Islands and other tax havens.

Experts blame a lack of will on part of the FBR for not signing such treaties with these territories and independent countries.

The FBR’s decision coincides with a proposal floated by Pakistan Banking Association (PBA), calling for deleting a clause from an income tax law that bars tax authorities from asking about the real source of income of foreign remittances.

Under Section 111 of the Income Tax Ordinance, if a person cannot explain the source of income or asset to the satisfaction of tax authorities, the FBR Commissioner can treat that income or asset as taxable income.

However, through Section 111-4, the government has exempted beneficiaries of foreign remittances from such treatment.

Tax scheme to legalise hidden assets on the cards

The PBA proposed to delete this section from the next financial year, FBR officials said.

It is suspected that a significant portion of remittances received in Pakistan every year is actually remitted from Pakistan and routed back using banking channels to claim it as legal income. This is one of the main sources of money laundering, said the sources.

Over 7% of the remittances consist of transactions valuing $25,000 or more, according to Tax Reforms Commission findings. A majority of remittance transactions are in the range of $1,000 or above, sent by labourers working abroad to their families.

The officials said that the FBR might propose an amendment to the law to add a ‘discovery year’ clause aimed at allowing the authority to reopen tax evasion cases on availability of credible information, irrespective of the tax year.

Government mulls ‘asset regularisation scheme’

The officials said that under Section 2014-A, the five-year time-bar could be condoned. But the problem is that this amendment was introduced in 2009 and it could not be applied retrospectively.

There was also a clause, Section 109 of Income Tax Ordinance, that authorized the FBR Commissioner to re-characterise incomes related to a tax avoidance scheme.

Published in The Express Tribune, April 21st, 2016.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ