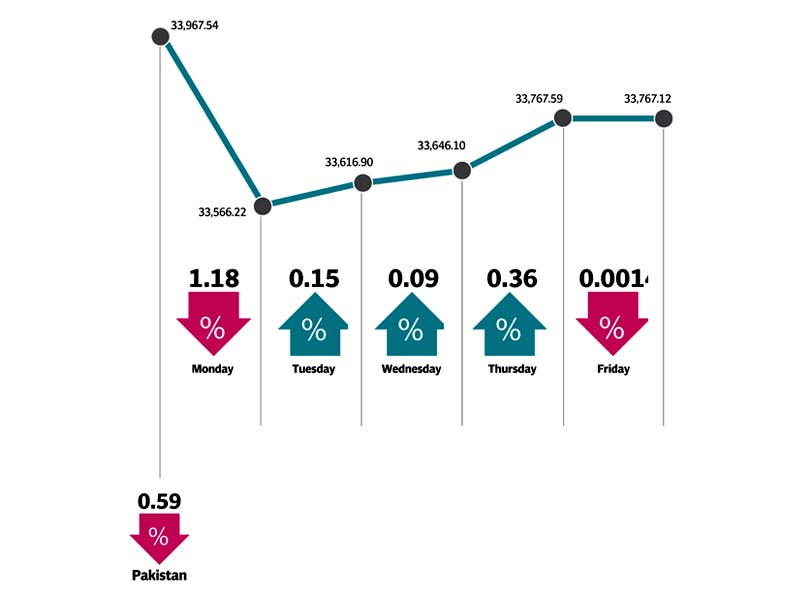

The market remained range-bound this week, as the after-shocks from the Panama leaks continued to take their toll. The index closed at 33,767, down 0.73% or 248 points week-on-week. The decline generally corresponds to decreased market participation in the outgoing week amidst political noise

However, market relief came from the onslaught of the results announcements coming in, especially the extraordinary quarterly results posted by the oil and gas sector.

The week started off with the market struggling to maintain momentum amid political uncertainty and dropping 1.18%. The rest of the sessions barring Friday remained positive with the week ending on a dull note owing to falling crude prices. On the sector front, cements (-1.5% WoW) and power (-1.3% WoW) closed in the red mainly on account of general profit taking observed during the week whereas oil and gas sector recovered by 1% on the back of recovery in international crude oil prices, providing some respite to the overall index level.

Negative implications for the cement sector came as news broke out of Saudi Arabia lifting the ban on exporting cement while a similar ban on steel has also been eased. Analyst predict that the removal of ban will dent Pakistan’s exports to Middle Eastern markets in the near to medium term.

Additionally, the increase in auto sales numbers by 11% month-on-month during March 16 with Honda Car (HCAR) and Indus Motor (INDU) posting double digit growths also spurred investor’s activity. Approval of PIA Bill to convert the national flag carrier into a public limited company also dominated the weekly news but it brought little impact on the bourse.

It is expected that the coming week will see more earnings surprises in cements, autos, banks and steel sectors.

Foreign investors were net sellers of $1.5 million during the week. Net selling worth $7.4 million was seen in the banking sector stocks. Cement stocks continued to attract attention as net buying worth $3.9 million was seen in them. Average daily volumes shrunk by 31% and were recorded at 190 million.

Winners of the week

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Pakistan Oilfields

Pakistan Oilfields Limited specialises in the exploration, drilling, production and transmission of petroleum. The company also markets Liquefied Petroleum Gas (LPG).

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Losers of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Gul Ahmed Textile

Gul Ahmed Textile Mills Limited manufactures and sells textile products.

Faysal Bank

Faysal Bank Limited provides commercial, consumer and investment banking services.

Published in The Express Tribune, April 17th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732503274-0/Untitled-design-(43)1732503274-0-405x300.webp)

1732501636-0/Untitled-design-(42)1732501636-0-165x106.webp)

1732498967-0/Outer-Banks--(1)1732498967-0-165x106.webp)

1732086766-0/BeFunky-collage-(74)1732086766-0-165x106.webp)

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ