Weekly review: KSE-100 gains 517 points as trading volume doubles

Proposed amendments to trading regulations resulted in a sharp jump in volumes

Proposed amendments to trading regulations resulted in a sharp jump in volumes.

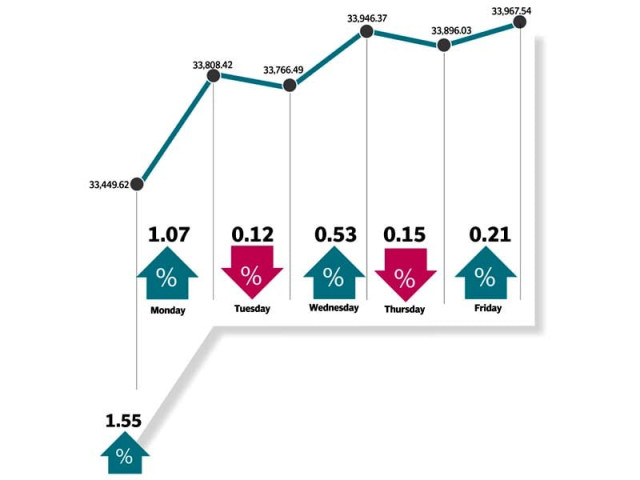

The stock market continued to make impressive gains as investors reacted positively to proposals to increase liquidity at the bourse, resulting in the benchmark KSE-100 index climbing 517 points (1.5%) to close just shy of the 34,000-point barrier during the week ended April 8.

The Securities and Exchange Commission of Pakistan (SECP), the regulator of the Pakistan Stock Exchange, proposed a number of changes during the week in a bid to increase market participation, which resulted in trading volumes doubling over the previous week. Strong support to the index came from the cement, communications and the fertiliser sectors, all of which contributed to the index’s gains.

The week started off on a positive note, with the cement sector leading the way as investors anticipated impressive sales figures from the cement sector in March. The oil and gas sector also contributed to gains by mid-week as oil prices rose following a decline in US inventory numbers. The KSE-100 index rose 497 points in the opening 3 days of the week.

The latter half of the week was a mixed bag as profit-taking in some sectors along with selling in the banking and auto sectors restricted the KSE-100’s gains. The index ended the week with a 71 point gain on Friday, to close at 33,967 points.

The cement sector was the star performer of the week as investors invested heavily in the sector before and after the release of dispatch figures for March. The sector posted a month-on-month gain of 19.4% in March which kept interest high, despite news of the government planning to further curtail the Public Sector Development Budget.

It was a mixed week for the oil and gas sector as the first half of the week saw oil prices fall below $40 per barrel as producers failed to reach a decision on production cuts. However, news of US inventory numbers declining resulted in oil prices recovering to their previous level, taking the sector in tow. It was a good week for Pakistan Telecommunications Limited as news emerged that the PTA may set a floor price on calling rates. While the fertiliser sector was provided a lift by Engro Corporation and Fauji Fertilizer Bin Qasim, which is all set to start operations of its meat processing plant.

Foreigners tuned net buyers this week, aided heavily by the $28 million investment by Vitol to purchase 15% shares of Hascol, according to a research report by KASB Securities. Net inflows stood at $27.6 million as opposed to a net outflow of $9.6 million during the previous week.

Average daily volumes rose a whopping 96.5% and were recorded at 275.3 million shares traded per day. Most of the activity was focused on lower-cap stocks which saw average daily values rise a relatively modest 43.6% to Rs10.5 billion per day. The Pakistan Stock Exchange’s market capitalisation stood at Rs7.08 trillion ($67.6 billion) at the end of the week.

Winners of the week

Hum Network Limited

Hum Network Ltd operates satellite television channels. The company operates a channel targeted primarily at women, one about food and one that covers entertainment.

Nestle Pakistan Limited

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees and dietary products.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices in Pakistan and elsewhere throughout the world.

Losers of the week

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group offers a number of lines of coverage, including fire, marine, aviation, transport, motor and miscellaneous.

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of kinds of health foods.

Published in The Express Tribune, April 10th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ