Weekly review: KSE-100 climbs 573 points on positive news flow

Oil, cement and fertiliser sectors provided impetus; foreign investors take interest

Oil, cement and fertiliser sectors provided impetus; foreign investors take interest.

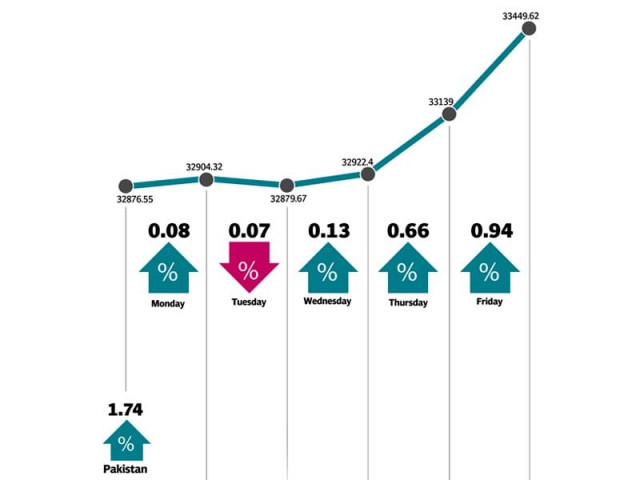

The stock market came back to life and rebounded sharply as a flurry of positive news flows helped the benchmark KSE-100 index post a 573 point (1.7%) gain to close at 33,450 points during the week ended April 2.

The bulk of the gains came from the oil and gas, cement and fertiliser sectors, all of which benefitted from specific news flows.

News about Pakistan’s re-entry into the MSCI Emerging Markets index and the International Monetary Fund approving the release of the 10th tranche of the stand-by agreement provided a further boost to the market.

The week started off slowly with the KSE-100 index remaining range-bound and trading in a 150-point range for the opening three days. In the absence of any significant triggers, the market focused on the cement sector in anticipation of strong sales figures for March.

The market came alive on Thursday as news of foreign buying in the cement sector, along with the announcement of Mari Petroleum’s discovery, triggered a rally at the bourse. A similar trend was witnessed on Friday as the market surged sharply in the second half of the day. The KSE-100 rose 526 points in the final 2 days to end the week at 33,450 points.

Oil prices remained volatile throughout the week and finally dipped below the $40 per barrel mark towards the end of the week. However, the sector performed strongly in light of Mari’s discovery and investor interest in the Oil and Gas Development Company and Pakistan Petroleum.

Cements were the star performers of the week on the back of anticipation of very strong sales numbers for the month of March. The gains came despite rumours of import of Iranian cement and were aided by strong foreign interest with foreigners purchasing a net of $4.3 million worth of cement stocks during the week.

The fertiliser sector also bounced back this week after weeks of decline due to fears of the government regulating prices in the sector. News about Engro’s CEO suggesting export of fertiliser due to excess inventory sparked interest in the sector with Engro and Fatima Fertilizer climbing 4.1% and 3.6% respectively.

Foreigners continued to be net sellers at the bourse offloading a net of $9.57 million worth of equity during the week as opposed to net selling of $2.31 million in the previous week. The selling was focused on the banking sector, which was partially offset by buying in the cement sector.

Average daily volumes shot up by 24% and were recorded at 140.1 million shares traded per day as opposed to 112.9 million shares per day in the previous week. Average daily values posted a bigger improvement and were up by 37.9% to Rs7.31 billion per day. The Pakistan Stock Exchange’s market capitalisation stood at Rs6.96 trillion ($66.4 billion) at the end of the week.

Winners of the week

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of kinds of health foods.

Millat Tractors

Millat Tractors Limited assembles and manufactures tractors,

implements, and equipments.

Punjab Oil

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Losers of the week

GlaxoSmithKline

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

Soneri Bank (XD)

Soneri Bank Limited provides banking services.

Askari Bank (XD)

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu and Kashmir and Bahrain.

Published in The Express Tribune, April 3rd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ