Weekly review: Index climbs 282 points after mid-week rally

Equities recovered in the latter half to wipe out earlier losses

Equities recovered in the latter half to wipe out earlier losses.

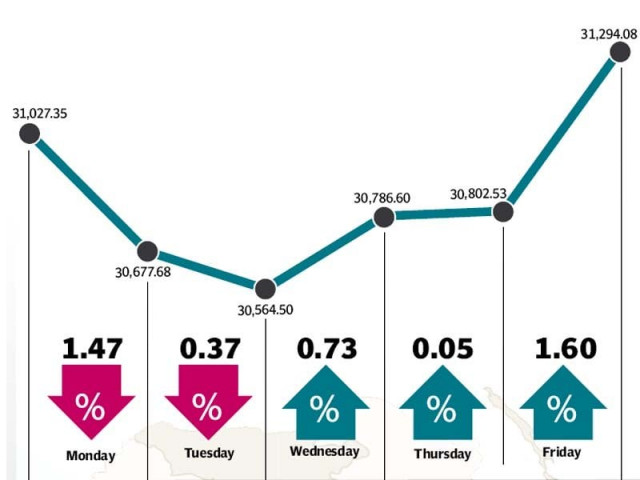

The stock market witnessed a topsy-turvy ride during the week as the benchmark KSE-100 index fell sharply in the opening couple of days only to post a strong recovery towards the end of the week, recording an overall gain of 282 points (0.9%) to close at 31,294.

Volatility in global crude oil prices and negativity surrounding particular sectors kept the market on edge, but it was value buying in blue-chip companies towards the end of the week, which led to the KSE-100 ending the week in the green.

The week started off on a negative note as oil prices again headed downwards over the weekend while the cement sector came under pressure following Lucky Cement’s earnings announcement. The KSE-100 index lost 447 points in the opening two days and looked battered after six continuous days of losses.

However, the losing streak came to an end on Wednesday as value buyers stepped in and started buying in blue-chip companies. A flurry of positive earnings announcements also improved the mood at the bourse and the index managed to rack up 713 points in the final three days to end the week with a decent gain.

Oil prices continued to play a major role at the bourse as crude prices steadily recovered throughout the week, coinciding with the positivity at the bourse. The price of Brent crude crossed $35 per in the latter part of the week and resulted in decent gains for the oil and gas sector.

Value buyers stepped in to pick up blue-chip stocks at attractive valuations. A lot of activity was witnessed in the shares of the oil and gas development company, MCB Bank, Engro Corporation and Kot Addu Power Company, which cumulatively added 225 points to the KSE-100 index during the week.

The cement sector also benefitted from the late rally, but could only manage to recover its earlier losses as persistent rumours of a price war and an average result announcement by Lucky Cement tore through the sector in the opening few days.

Foreigners were again net sellers at the bourse and offloaded net equity worth $4.82 million during the week, down from the $13.2 million net selling in the previous week. With regional markets still suffering from an exodus of foreign investors, the direction of foreign flows seems very unlikely to switch anytime soon.

Average daily volumes were up 11.5% and stood at to 138.2 million shares traded per day, while average daily values fell slightly by 5.8% and were recorded at Rs6.23 billion per day. The Pakistan Stock Exchange’s market capitalisation stood at Rs6.58 trillion ($62.9 billion) at the end of the week.

Winners of the week

Associated Services Limited

Earlier called Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

Ghani Glass

Ghani Glass Limited manufactures and sells glass containers. The company manufactures international glass containers for pharma, food and beverage. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

Jahangir Siddiqui & Co

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Losers of the week

Orix Leasing

Orix Leasing Pakistan Limited is a leasing and diversified financial services company. The company offers full pay out finance leases for machinery, office automation, computers, vessels, aircraft and automobiles. Orix financial service products include loans, rentals, security brokerage, options trading and life insurance products.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Searle Company

Searle Company Limited manufactures and sells pharmaceutical and healthcare products. The company also sells a range of food products and consumer items.

Published in The Express Tribune, February 28th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ