Weekly review: KSE-100 sheds 452 points amid volatility

Uncertainty over global markets and oil prices were primary reasons for decline

Uncertainty over global markets and oil prices were primary reasons for decline.

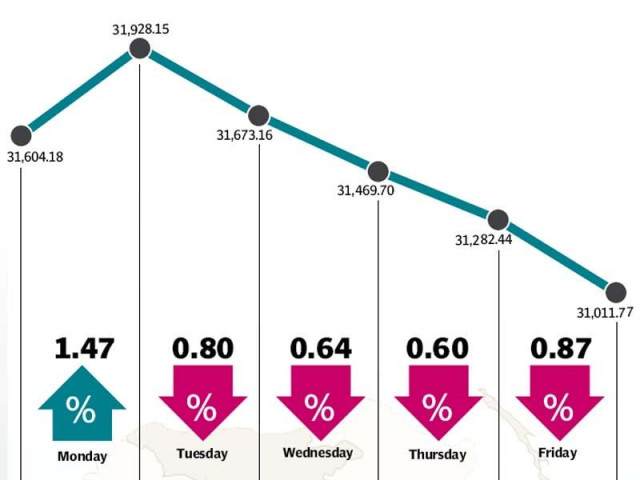

The stock market continued its downward slide as volatile global markets and oil prices weighed heavily on the bourse, resulting in the benchmark KSE-100 index falling by 452 points (1.4%) during the week ended February 19.

The decline came despite impressive earnings announcements from several blue-chip companies that failed to improve investor sentiment. Negative news flows for the cement and fertiliser sectors also dampened sentiments while continuous foreign outflows also took toll on the bourse.

The week opened on a strong note on the back of a sharp rebound in oil prices over the weekend which resulted in the KSE-100 index shooting up by 464 points (1.5%) on Monday. However, the sentiment changed quickly the following day with profit-taking kicking in, after the index reached an intra-day high of 32,159, to eventually close down by 255 points at 31,673.

The KSE-100’s bearish streak continued throughout the rest of the week with oil prices again heading downwards and negative sector-specific news flows. The index would shed another 661 points (2%) in the remaining three days to end the week at 31,012.

Crude oil prices continued to be extremely volatile, resulting in high volatility at the bourse. After a strong start to the week, fueled by news of Saudi Arabia and Russia agreeing to freeze production at January levels, oil prices went up and down throughout the week with WTI Crude ending the week around the $30 per barrel mark.

The major loser of the week was the fertiliser sector as rumours of gas price hike and Engro Corporation selling its stake in Engro Fertilizer made rounds at the bourse. The sectors largest players, Engro and Fauji Fertilizers, were both down and cumulatively knocked off 80 points from the KSE-100 index.

Another sector in hot waters was the cement sector, which continued to face pressure despite strong earnings announcement by manufacturers. Fears of a price war between the manufacturers affected market sentiment resulting in a sharp decline in the sector overall.

The banking sector was a mixed bag with United Bank Limited announcing disappointing earnings, but National Bank of Pakistan surprised with a strong result which was coupled with a nice payout. National Bank’s share price rose 7.4% during the week and provided a big boost to the sector.

Another major factor in the index’s decline was the continued sell off by foreign investors. Foreigners offloaded net equity worth $13.2 million during the week, a mild improvement over the $17.3 million sell off in the previous week.

Average daily volumes fell 12% to 123.9 million shares traded per day, while average daily values also fell 17% to Rs6.62 billion per day. The Pakistan Stock Exchange’s market capitalisation stood at Rs6.53 trillion ($62.4 billion) at the end of the week.

Winners of the week

JDW Sugar

JDW Sugar Mills Limited produces and sells crystalline sugar. The company is located in District Rahim Yar Khan and formerly named United Sugar Mills Limited.

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group provides a number of lines of coverage, including fire, marine, aviation, transport, motor and miscellaneous.

Murree Brewery

Murree Brewery specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Losers of the week

Sui Southern Gas Company

Sui Southern Gas Company Limited transmits and distributes natural gas, and constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balochistan to Karachi in Sindh.

Jahangir Siddiqui & Co

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Published in The Express Tribune, February 21st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ